Shares for the future: a company profiting from fresh air

It’s hard not to like this billion-pound company, and a strong share price demonstrates what a good business it is, argues analyst Richard Beddard. Here he spells out the rationale.

28th November 2025 15:00

by Richard Beddard from interactive investor

It’s hard not to like Volution Group (LSE:FAN). The company manufactures products that make us healthier. And it makes money, consistently.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

Volution: profiting from fresh air

In its own words, Volution manufactures ventilation systems for “any buildings requiring fresh air”. Principally, that means our homes, which contribute about 70% of revenue via distributors. The company earns 30% of revenue from commercial ventilation systems ultimately supplied to schools, offices, hospitals, airports, tunnels, car parks, and data centres, for example.

Volution products we might find in our homes include extractor fans, positive input systems, mechanical ventilation and heat recovery (MVHR) units, and cooling fans. For those of us who still open the bedroom window for ventilation, Volution’s website includes a glossary of these and many other ventilation terms.

Vent-Axia is Volution’s best-known UK brand. The subsidiary’s managing director since 2008, Ronnie George, became chief executive of the group in 2012. Since then, he has grown Volution from a UK-focused business into a multinational, by acquiring 29 brands in 17 countries.

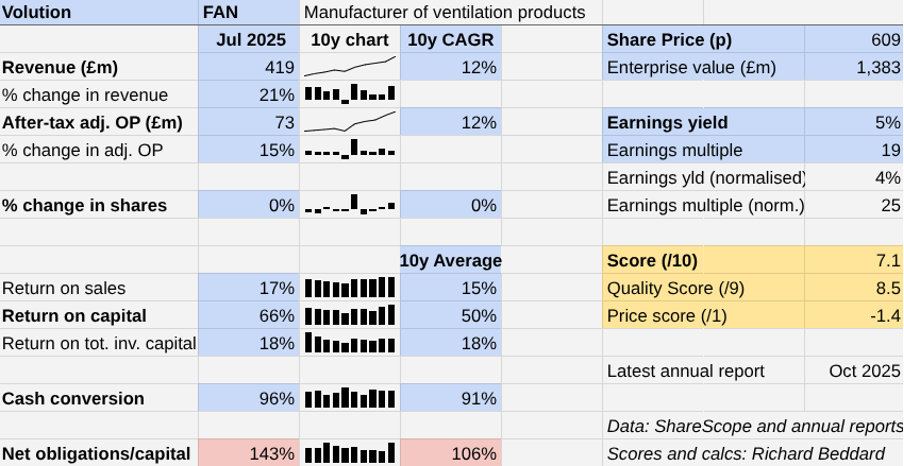

So far, this strategy has been highly profitable and cash generative. Volution has achieved compound annual growth in profit of 12% over the last 10 years, without raising significant amounts of money from shareholders. In other words, it is growing under its own steam.

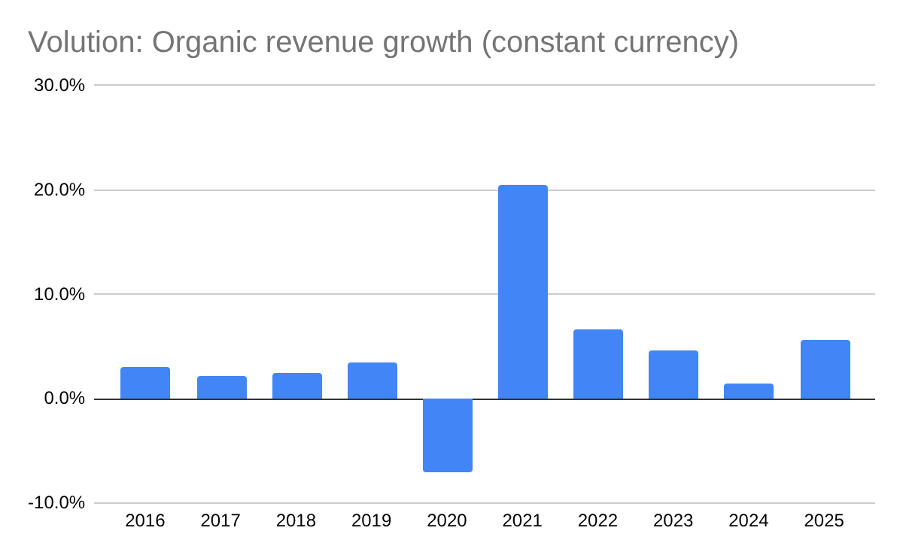

In the year to July 2025, Volution achieved above average organic revenue growth of 5.7%. The acquisition of Fantech in November 2024, about a third of the way through the financial year, led to an above average 21% increase in revenue and 15% increase in profit.

In 2026, Fantech will contribute revenue and profit for a full year, instead of eight months, and the company says that despite the difficult economic backdrop, Volution expects another year of “good progress”.

Debt and cyclicality

Above average growth came at a cost in the form of debt used to buy Fantech. Volution’s net financial obligations are greater than the operating capital required to run the business, but less than two times free cashflow in 2025. To my mind, this makes Fantech a big acquisition, but given Volution’s track record, and the speed with which it could pay back the debt, it is perhaps not an especially risky one.

It is not clear from Volution’s annual report how dependent the company is on 2,000 material and components suppliers, mostly in the Far East. This could be a concern if trade barriers strengthen, but this decade the company has coped with the shutdown of Chinese suppliers during the Covid pandemic, subsequent shortages of raw materials and electronic components, and most recently disruption to shipping in the Red Sea. It has been able to find alternate sources, re-engineer products to use different materials and components, and stockpile when it has foresight.

When, like now, high interest rates and economic uncertainty subdue construction, demand weakens. However, Volution is still prospering. Tighter building regulations and rules for landlords seem to be a countervailing force. So too is the fact that most residential products are fitted in existing homes, which is a steadier source of income. Only 38% of Volution’s residential revenue comes from new builds.

Growing better by growing bigger

Australia’s Fantech is Volution’s biggest acquisition. It lifted Australia and New Zealand’s contribution of total revenue from 15% in 2024 to 25% in 2025. The region will probably bring in close to 30% of revenue in 2026. In comparison, Volution earned 42% of revenue in the UK and 39% in Continental Europe in 2025.

While Fantech is Volution’s largest acquisition, the addition of all the goodwill and acquired intangible assets at the acquisition cost has barely dented after-tax Return on Total Invested Capital (ROTIC). The company achieved 18% ROTIC in 2015, suggesting that it has not been overpaying for businesses.

Acquisitions are funded by Volution’s strong cash flow. In theory, this is self-perpetuating because, Volution says, the bigger it gets, the more competitive it gets.

The company believes scale sets it apart from peers.

Scale enables it to grow revenue by cross-selling thousands of products through its distributors and supplying all of the needs of large commercial projects.

Scale also improves profitability. By cross-selling and sharing intellectual property, the company reduces development costs for its subsidiaries. For example, it has launched a range of the group’s MVHR units in Australasia.

Also in Australasia, where Fantech has roughly doubled its presence, Volution is integrating Fantech’s purchasing with the other subsidiaries in the region in the expectation that it will pay less for raw materials and components. It also plans to use Fantech’s distribution network to hold local stocks for subsidiaries with less extensive logistics in Australia.

Scale can also improve operational efficiency. In the annual report, the company explains that now its VoltAir subsidiary’s product range has expanded, it is cost effective to manufacture sheet panels in house. This reduces cost, presumably by cutting out supplier margins, and improves stock management. VoltAir is a Swedish manufacturer of air handling units, ventilation devices that integrate heating and air filtration.

Investments in manufacturing can be lumpy and costly, but at Volution it appears to be incremental and modest. The company has typically spent less than 2.5% of revenue a year on capital expenditure over the last 10 years, justifying its claim to be “capital light”. Capital is the denominator of the Return on Capital calculation, and Volution’s apparently modest capital expenditure goes some way to explaining its extraordinary profitability.

Scoring Volution: hard not to like

I like Volution. Organic growth has improved this decade, helped by an increasing awareness of the health implications of poor air quality following the Covid pandemic, and what Volution describes as an “acute” focus on reducing mould in housing.

For example, Awaab’s Law came into effect on 27 October. The law was passed in 2023, after the death of a two-year-old from a respiratory condition due to prolonged exposure to mould in his family’s flat. It requires social housing landlords to investigate and fix damp and mouldy houses promptly. On the same day, the Renters’ Rights Act received royal assent. It will extend Awaab’s law to the private sector, but the date has yet to be determined.

In addition, the drive to reduce fuel costs and carbon emissions emitted by buildings is increasing demand for higher-value products like MVHR systems.

Volution | FAN | Manufacturer of ventilation products | 25/11/2025 | 7.1/10 |

How capably has Volution made money? | 3.0 | |||

Under chief executive Ronnie George, Volution has grown revenue and profit at 12% CAGR since it floated in 2014. Most of this growth has been through acquisitions. Volution’s subsidiary brands are highly profitable and cash generative, which is probably a result of its scale. | ||||

How big are the risks? | 2.5 | |||

The acquisition of Fantech in November 2024 has lifted debt to a high level compared to capital employed, although net debt is only about two times 2025 cash flow. A Chinese supply chain and cyclical end markets could dent profitability, but so far the company has prospered despite them. | ||||

How fair and coherent is its strategy? | 3.0 | |||

Volution is building scale to become more efficient, and using the cash flow to build more scale through acquisitions. A high ROTIC indicates it is efficient, and has not overpaid for acquisitions. The company’s products improve air quality, and consequently our health. Employees appear engaged. | ||||

How low (high) is the share price compared to normalised profit? | -1.4 | |||

High. A share price of 618p values the enterprise at £1,401 million, about 26 times normalised profit. | ||||

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explainedhere) | ||||

These products are beneficial and chief executive Ronnie George says the result of the employee engagement survey - a score of 75 compared to 74 the previous year - is “very encouraging”. Volution is a people business, he says, and he is amply rewarded for orchestrating them. He earned 93 times the total pay of the median employee in 2025.

The biggest of few negatives, is the share price, which recognises what a good business Volution is.

30 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 5 out of 10 to be worthy of long-term investment in sizes determined by the ideal holding size (ihs%).

Tristel (LSE:TSTL) has published its annual report and is due to be re-scored.

company | description | score | qual | price | ih% | |

1 | FW Thorpe | Makes lighting systems for commercial, industrial and public settings | 9.0 | 0.7 | 9.5% | |

2 | Howden Joinery | Supplies kitchens to small builders | 8.0 | 0.6 | 7.2% | |

3 | James Latham | Distributes imported panel products, timber, and laminates | 7.5 | 1.0 | 7.0% | |

4 | Bunzl | Distributes essential everyday items consumed by organisations | 7.5 | 0.6 | 6.2% | |

5 | Softcat | Sells software and hardware to businesses and public sector | 7.5 | 0.5 | 6.1% | |

6 | Auto Trader | Online marketplace for motor vehicles | 8.0 | 0.0 | 6.0% | |

7 | Solid State | Manufactures electronic systems and distributes components | 7.0 | 1.0 | 5.9% | |

8 | Jet2 | Package tour operator and leisure airline | 7.0 | 1.0 | 5.9% | |

9 | Judges Scientific | Manufactures scientific instruments | 7.5 | 0.5 | 5.9% | |

10 | Hollywood Bowl | Operates tenpin bowling centres | 7.5 | 0.1 | 5.2% | |

11 | Churchill China | Manufactures tableware for restaurants etc. | 6.5 | 1.0 | 5.0% | |

12 | Oxford Instruments | Makes imaging and semiconductor manufacturing systems | 6.5 | 1.0 | 5.0% | |

13 | Bloomsbury Publishing | Publishes books and educational resources | 7.5 | -0.1 | 4.7% | |

14 | Porvair | Manufactures filters and laboratory equipment | 8.0 | -0.6 | 4.7% | |

15 | Renew | Maintenance and improvement of national infrastructure | 7.5 | -0.3 | 4.4% | |

16 | Volution | Manufacturer of ventilation products | 7.1 | 8.5 | -1.4 | 4.2% |

17 | Advanced Medical Solutions | Manufactures surgical adhesives, sutures and dressings | 6.5 | 0.6 | 4.1% | |

18 | Cohort | Manufactures/supplies defence tech, training, consultancy | 8.0 | -1.0 | 4.1% | |

19 | Focusrite | Designs recording equipment, synthesisers and sound systems | 6.0 | 1.0 | 4.0% | |

20 | Macfarlane | Distributes and manufactures protective packaging | 6.0 | 1.0 | 4.0% | |

21 | Anpario | Manufactures natural animal feed additives | 7.0 | 0.0 | 3.9% | |

22 | Cake Box | Cake shop franchise and sweet manufacturer | 7.0 | -0.1 | 3.8% | |

23 | Goodwin | Casts and machines steel and processes minerals for niche markets | 8.5 | -1.6 | 3.8% | |

24 | YouGov | Surveys public opinion and conducts market research online | 6.0 | 0.8 | 3.7% | |

25 | Keystone Law | Operates a network of self-employed lawyers | 7.5 | -0.7 | 3.7% | |

26 | Games Workshop | Designs, makes and distributes Warhammer. Licenses IP | 8.5 | -1.7 | 3.5% | |

27 | 4Imprint | Customises and distributes promotional goods | 8.0 | -1.5 | 3.0% | |

28 | Renishaw | Makes tools and systems for manufacturers | 6.5 | -0.3 | 2.5% | |

29 | Quartix | Supplies vehicle tracking systems to small fleets | 7.5 | -1.8 | 2.5% | |

30 | Tristel | Manufactures disinfectants for simple medical instruments and surfaces | 7.5 | -2.0 | 2.5% |

Click on a share’s score to see a breakdown (scores may have changed due to movements in share price). Key: qual is the share’s score out of 9 for the three quality factors (capabilities, risks, and strategy), price is the price score from -3 to +1, and ih% is the suggested ideal holding size as a percentage of the total value of a diversified portfolio.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.