Eight ways that investment trusts have an edge over funds

How to take full advantage of the benefits of investment trusts.

23rd October 2019 10:02

by Fiona Hamilton from interactive investor

How to take full advantage of the benefits of investment trusts.

Investment trusts, savings vehicles that have been around since the Victorian era, are regarded as the City's best-kept secret. However, for many seasoned investors and regular readers of Money Observer, investment trusts have formed the bedrock of their portfolios for decades. One reason for this is that investment trusts offer benefits that open-ended funds don't.

1) Use investment trust discounts to your advantage

The discount can be a trust investor's friend or their foe. It is the difference between a trust's net asset value (NAV) and its share price. If it tightens (reduces) while you hold trust shares, it enhances your share price returns, but if it widens, it detracts from them.

When considering a trust, don't focus on its share price returns, which can be distorted by discount changes. Look first at its NAV total returns relative to its peers and also to its benchmark, to decide whether it merits your attention. Then examine its discount relative to its peers, to decide if it looks fair.

There are other things to bear in mind. Is a new manager or new approach turning a trust's performance around? If that is the case, the discount should be narrowing, as Monks (LSE:MNKS) discount did after changes to both in March 2015.

Has the trust introduced an enhanced yield that will pull in new investors, as JPMorgan Global Growth & Income (LSE:JPGI) did in 2017? Has its rating been excessively trashed by worries about a particular event, as was the case when HICL Infrastructure Company (LSE:HICL) fell to a 10% discount in early 2018 as concerns mounted over the threat of nationalisation?

Consider too whether all the trusts in a sector have been savagely de-rated despite many of them having proven managers and reasonably solid balance sheets, as happened when private equity funds of funds fell to an average 57.7% discount at the end of 2008. A year later the average discount was down to 31% and the average share price was up by 42%.

If discounts worry you, find a trust committed to keeping its share price within a few percentage points of its NAV, as Personal Assets Trust (LSE:PNL) has since the 1990s. Mid Wynd International Investment trust (LSE:MWY), Martin Currie Global Portfolio Trust (LSE:MNP), Capital Gearing (LSE:CGT), Seneca Global Income & Growth Trust (LSE:SIGT), the Jupiter UK Growth, Invesco Perpetual Select (LSE:IVPU), BlackRock Income and Growth IT (LSE:BRIG) and Troy Income & Growth (LSE:TIGT) also have explicit ‘zero discount' policies. Baillie Gifford has indicated that having issued new shares at a small premium on most of its trusts when demand was high, it expects to conduct active buybacks to limit any discount in tough markets.

Specialised trusts, particularly those investing in less liquid assets, cannot adopt such a policy, so short-term investors need to be careful about buying into them on low single-digit discounts.

Rule of thumb: seek out unjustifiably wide discounts that could narrow.

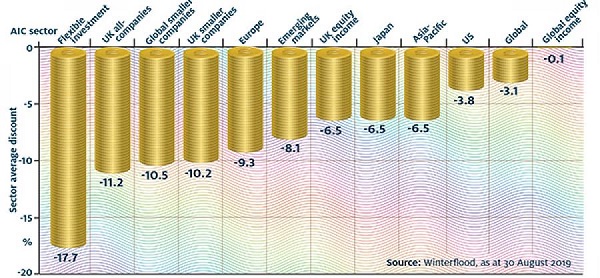

Discounts to NAV can look compelling but consider the context

2) Take care with large premiums

Buying investment trust shares at a large premium can damage your wealth, as those who were sucked into this summer's enthusiasm for Lindsell Train (LSE:LTI) can attest. The trust's impressive record and hopes that its large stake in its management company would continue to prove exceptionally rewarding drove its shares to a premium of 100% and a July high of £2,000 a share before they subsided to their current level of £1,350 and a still-demanding premium of 27%.

Trusts must offer something genuinely rich and rare to justify double-digit premiums. This might be the case with idiosyncratic life sciences specialist Sycona, currently trading at a premium of around 20% against a peak of more than 50% earlier this year, but if it disappoints, the fall will be painful.

With most equity-oriented trusts, it is advisable to avoid paying premiums of more than 5%, no matter how well they are performing, as most will boost their NAVs by issuing new shares at a low single-digit premium when this is the case.

Rule of thumb: you may have to pay a premium for income-focused trusts.

3) Keep an eye out for gearing

The ability to gear (borrow money) is beneficial for investment trusts as long as the returns on the investments the gearing finances are higher than the costs of borrowing.

This is easier to achieve if borrowings are low-cost, which is why many trusts have taken out long-term gearing while interest rates have been low, in some cases using at least part of their borrowings to repay older, more expensive debt. But even low-cost gearing can exacerbate a trust's problems in a falling market.

Many income-oriented investment trusts use gearing to enhance yields. They do this by using the income generated from the portfolio's underlying assets to boost their revenue while charging most of the costs of the gearing to capital.

Murray International (LSE:MYI) 4.7% yield, for example, is bolstered by its 11% gearing. All its borrowed funds are currently invested in emerging market fixed-interest securities, interest on which contributed 27% of last year's total income. Meanwhile, 70% of finance costs are charged to capital.

Some trusts avoid gearing on the grounds that their asset classes are volatile enough without exacerbating the situation with gearing. JPMorgan Emerging Markets (LSE:JMG) is a case in point, and its fine record demonstrates that avoiding gearing need not be a handicap. Troy Income & Growth (LSE:TIGT) is also reluctant to gear, which is one reason why its yield is relatively low for its sector. Avoiding gearing contributes to Troy's capital preservation philosophy.

Rule of thumb: avoid trusts using gearing if you're worried about capital preservation.

4) Specialist trusts promise profitable diversification

Specialist trusts can add excitement to a well-diversified portfolio. But stepping off the beaten track can go horribly wrong, as with the CATCo Reinsurance Opportunities (LSE:CAT) and Ranger Direct Lending funds, both of which are being wound up.

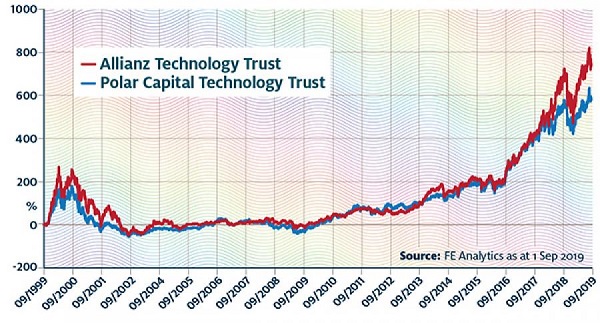

Timing can be critical to success. Biotech trusts were big winners in the first half of the current decade, whereas technology trusts have taken up the running in the second half. The NAVs of both Allianz Technology Trust (LSE:ATT) and Polar Capital Technology (LSE:PCT) have almost tripled in the past five years. But over 20 years, a period that includes the boom and bust of the technology bubble at the turn of the century, there have been plenty of peaks and troughs for the trusts' share prices, as the chart shows. Holding your nerve, rather than trying to time the market, has been key.

The fortunes of BlackRock World Mining Trust (LSE:BRWM) illustrates the rollercoaster ride that specialists may endure.

The trust invests in a globally diversified portfolio of mining companies, and supplements its income from royalties and writing options. Its NAV per share rose from 75p at the end of 1997 to 804p at the end of 2007; it then fell to 331p 12 months later, recovered to 962p by the end of 2010, drifted back down to 212p by the end of 2015 and then rose 80% to 383p in 2016.

It is currently a bit lower than that. In contrast, the tiny Golden Prospects Precious Metals trust has seen its NAV per share more than double in the year to date, and the rise in its share price has been even more dramatic.

Investment trusts are well-suited to investing in less-liquid assets classes, as investors can't quickly withdraw money if they lose confidence, but must try to find a buyer for their shares.

Trusts therefore offer a good way to invest in single-country emerging markets. They are also a far better route into commercial property than open-ended funds, which have to hold a lot of liquidity to fund redemptions and still tend to shut up shop when panic sets in.

What's more, investment trusts offer the only way for most investors to access private equity, a highly rewarding sector over the past 30 years.

Investment trusts offer exposure to a wide range of illiquid debt and other alternatives to equities, such as infrastructure funds. Henderson Diversified Income (LSE:HDIV) invests in a variety of global fixed- and floating-rate income asset classes and offers a 4.8% yield.

Rule of thumb: closed-ended structure suits specialist investment, but you need to take long view.

Biotech trust shares soaring in past 10 years

5) Understand the benefits of an independent board

Independent boards are the unsung heroes of the investment trust world, especially now that they are more diverse than they were a decade ago; most now include at least one woman.

Open-ended funds are proposing to make their ‘governing bodies’ more independent, but nowhere near as independent as most investment trust boards.

The directors of a trust are responsible for ensuring that its remit remains relevant to investors' interests and that the trust's managers deliver. If not, directors can move their mandate to another fund manager, as Mid Wynd International (LSE:MWY) did when it successfully moved its mandate to Artemis in May 2014. Alternatively, they can demand a change of direction and personnel. Alliance Trust (LSE:ATST) undertook an extensive realignment in March 2017.

The board is also responsible for making sure its trust's running costs remain competitive, and it is heartening that so many trusts have reduced their charges in recent years. Boards also set and manage gearing levels.

Rule of thumb: shareholders have the right to attend annual general meetings.

6) Beginners wise to consider global generalists

Global generalist trusts make ideal core holdings for those who believe that, for all their ups and downs, equities remain a great way to achieve long-term growth in both income and capital. On the whole, global trusts tend to have lower charges than their open-ended fund counterparts, with Bankers (LSE:BNKR), Monks (LSE:MNKS), Scottish Investment Trust and Scottish Mortgage IT, for example, all having ongoing charges of 0.5% or less.

Global trust managers relieve investors of the need to worry about rebalancing portfolios between different regions and sectors, as they will do this for them within the tax-free envelope of the trust. Thus they are core 'one-stop shop' investments and ideal for novice investors.

There is a wide choice of global generalist trusts – as outlined in the September 2019 issue of Money Observer – so investors must choose carefully. Alliance Trust, Bankers, Brunner (LSE:BUT), F&C Investment Trust (LSE:FCIT), Scottish Investment Trust (LSE:SCIN) and Witan (LSE:WTAN), for example, have raised their dividends every year for between 35 and 52 years – something they take great pride in – and they are determined to continue to raise them. These trusts tick boxes for investors who deem modest but steadily rising income important.

Investors who prefer a trust that has achieved exceptional returns over the past 10 years – and can live with the trust manager’s warning of possible volatility over the short term – might favour Scottish Mortgage (LSE:SMT). On the other hand, those who prefer a trust with a more diversified portfolio and a less volatile record may be more comfortable with Bankers, F&C or Witan, all of which have outperformed the MSCI All Country World index over the past 10 years.

Rule of thumb: global trusts can't be beaten as a simple, low-cost entry point.

7) Seek out trust boards that have 'skin in the game'

The directors of a trust are said to have ‘skin in the game’ when they have a large enough stake in its shares to suffer financially if the trust does badly. When this is the case, investors can be confident that the board shares their interests and will act if it becomes worried that the trust is not performing as well as it should.

The size of each director's stake is published annually in a trust’s report and accounts. However, just how much constitutes a significant shareholding is a moot point. Directors with multi-million-pound interests clearly have a huge commitment, as in the case of Douglas McDougall at both the Independent Investment Trust and Monks.

Investors can be even more confident that a director is committed to achieving the best possible long-term returns if members of that director's family also have multi-million-pound stakes, as is the case with Lord Rothschild and Hannah Rothschild at RIT Capital Partners (LSE:RCP), William Salomon at Hansa Trust (LSE:HAN), Will Wyatt at Caledonia Investments (LSE:CLDN), and Harry Henderson at Witan (LSE:WTAN). Recently appointed directors are likely to hold far smaller stakes, particularly if they are not wealthy.

James Henderson, manager of Law Debenture (LSE:LWDB), Lowland (LSE:LWI) and Henderson Opportunities (LSE:HOT), says some directors are more motivated by the intellectual challenge of their role and "getting it right" than the desire to make money. Nevertheless, it is discouraging if none of the directors of a trust have the confidence to accumulate significant stakes.

During his time as head of investment companies research at Canaccord Genuity, Alan Brierley published an annual report on the subject of skin in the game. In it he suggested that chairmen who had been on a board for at least five years should have a shareholding valued at more than their annual fee, and he praised 12 boards where all members had personal shareholdings equal to more than two years of fees. These included Bluefield Solar Income Fund (LSE:BSIF), EP Global Opportunities (LSE:EPG), Personal Assets (LSE:PNL) and Seneca Global Income & Growth Trust (LSE:SIGT).

It can be equally encouraging when a good manager has a lot of skin in the game, as this indicates that they will be reluctant to change jobs or take on too many other responsibilities. That said, it is hard to verify manager shareholdings, as only stakes exceeding 3% of issued capital must be published.

Managers with personal investments of more than £5 million in their trusts include Christopher Mills at North Atlantic Smaller Companies (LSE:NAS), Mark Sheppard at Manchester & London (LSE:MNL), John Duffield at New Star Investment Trust (LSE:NSI), Peter Spiller at Capital Gearing (LSE:CGT), Max Ward at Independent Investment Trust (LSE:IIT), Nick Train at Finsbury Growth & Income (LSE:FGT), Simon Edelsten at Mid Wynd International (LSE:MWY), Katie Potts at Herald (LSE:HRI), Charles Montanaro and family at Montanaro UK Smaller Companies (LSE:MTU), and the management teams at Scottish Mortgage (LSE:SMT), HgCapital Trust (LSE:HGT)Aberforth Smaller Companies (LSE:ASL), Monks (LSE:MNKS), ScotGems (LSE:SGEM) and Ecofin Global Utilities and Infrastructure Trust (LSE:EGL). Bear in mind, though, that large management stakes don’t guarantee stellar performance.

Rule of thumb: take confidence from trusts where the directors have personal stakes.

8) Look to trusts for sustainable income

Many trusts aim for capital gains rather than income, but a lot of investors love an attractive and steadily growing dividend. A total of 21 trusts in the UK equity income and global sectors have raised their dividends every year for between 20 and 53 years, with City of London IT, Bankers and Alliance Trust topping the list. A number of other trusts have grown their dividends steadily for at least 10 years, including three Asian income trusts: the Schroder Oriental Income (LSE:SOI), Henderson Far East Income (LSE:HFEL) and Aberdeen Asian Income (LSE:AAIF).

Investment trusts are well-placed to deliver steady income because they only have to distribute 85% of their earnings per share each year. The rest can be held in reserve and drawn down when needed. Since 2012 trusts have been allowed to pay dividends partly from capital. This has permitted trusts ranging from BMO Private Equity Trust (LSE:BPET) to JPMorgan Japan Smaller Companies (LSE:JPS) to pay well above-average dividends for their sectors, something many investors find attractive. However, these enhanced yields may prove more volatile than those financed from current earnings and revenue reserves, especially if they are linked to NAV per share, which can decline in a tough market – as investors in European Assets Trust are currently being reminded to their cost.

Rule of thumb: dividend growth is highly prized but yields may be relatively modest.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.