Richard Beddard: nerdy but essential changes to the Decision Engine

Our columnist updates the Engine to reward cheap shares less – here are the results.

1st April 2021 15:23

by Richard Beddard from interactive investor

Our columnist updates the Engine to reward cheap shares less – here are the results.

Bear with me. Today’s article may seem a little abstruse as I explain a modification to the Decision Engine’s price score, one of five factors I use to determine whether shares are good value.

And I need to come clean as to how the earnings yield that lies behind the price score is calculated.

These explanations are nerdy, but they are fundamental to investing.

Quality versus price

The scoring system now employs the same five criteria: profitability, risks, strategy, fairness and price, but they are weighted differently.

The first four criteria are still scored from 0 to 2.

The fifth, price, was always different. Shares could score between -2 and 2 because I wanted to penalise companies on low earnings yields as well as rewarding companies on high ones.

If you are unfamiliar with the earnings yield it is profit as a percentage of price, the inverse of price divided by profit (the well-known price earnings ratio). While high price earnings ratios might indicate a company’s shares are expensive, low earnings yields do.

Scoring price from -2 to 2 meant it was the most influential factor, but as I have grown to appreciate the qualities of the companies I have collected in the Decision Engine I have begun to doubt the strength of this influence.

- Is this FTSE 100 stock one to buy and hold?

- What I’ve learned about this education stock

- Two intriguing shares ripe for the Decision Engine

The latest bout of self-doubt was provoked, as is so often the case, by a reader who emailed me after I had tweaked my policy on how much of each Decision Engine share to hold in my portfolios.

The new policy was more aggressive. It directed me to own bigger holdings of the highest ranked shares and smaller holdings of lower ranked ones.

This should be a good thing, since the highest ranked shares should be my best ideas, but the Decision Engine was recommending trades I did not feel confident about.

It was urging me to buy more shares in companies that were cheap but otherwise undistinguished, and sell shares in companies that were distinguished but not cheap.

And that made me question whether the ranking could be improved.

As Martin Blindheim put it in his email to me: “Your new rule would make your system much more valuation-sensitive”. And, because prices change all the time but quality stays the course, I would be trading much more often.

Since my goal is to buy and hold good quality businesses, that is the opposite of what I wanted to achieve.

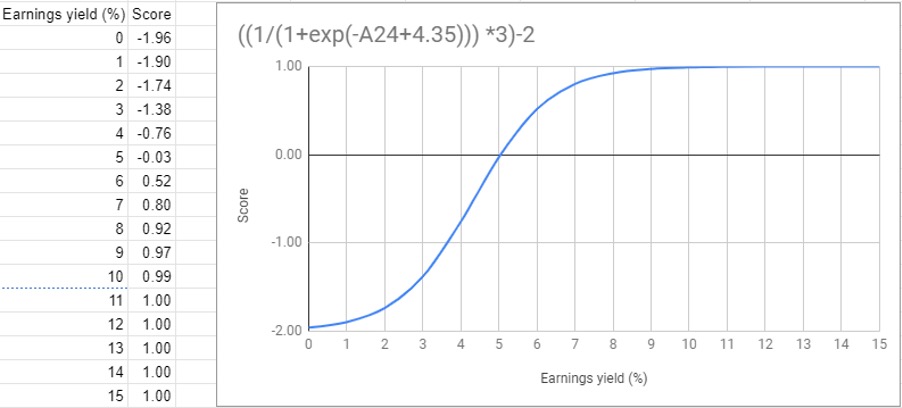

The solution I am trialling now is to score the price criterion from -2 to 1. Expensive shares are penalised just as much as they were. But cheap shares are rewarded less, up to a maximum score of 1.

One consequence of this change is that, rather heinously, the shares in the Decision Engine are now scored out of nine.

Another consequence is more pleasing. Companies that previously scored 1 or 2 for price have moved some way down the table. To a share, these were firms I have doubts about in terms of quality, like Portmeirion (LSE:PMP), Castings (LSE:CGS), Cohort (LSE:CHRT), Trifast (LSE:TRI), James Latham (LSE:LTHM) and RM (LSE:RM.).

I feel more comfortable with today’s ranking than I did with last month’s, and consequently I feel more confident about weighting my portfolios more heavily towards the higher-ranked shares.

Calculating the price score

The quality scores are judgements. Every year, I appraise each business, deciding whether to give it a 0, 1, or 2 for each criterion having analysed the annual report and perhaps visited the AGM, or, these days, watched an online presentation.

The price score changes in real time, and it is based on a slightly more convoluted version of the earnings yield than the basic definition I gave above: profit as a percentage of price.

- Discover our Terry Smith interview here

- Your chance to win £1,000: take part in the Great British Retirement Survey

For price I use enterprise value (EV), which is the value of the equity (market capitalisation) plus the value of net debt.

This is the price, or market value, of the whole business, in the same way that the price of a house is not how much you pay out of your own pocket but the amount you pay and the amount you borrow from the mortgage company.

One of the problems with the standard price-to-earnings (PE) ratio or earnings yield, which just uses price or market capitalisation, is that it is skewed by debt. Using EV puts companies on a level playing field, pricing them as though we have repaid the debt.

I calculate profit by multiplying the company’s return on capital, usually averaged over many years, by capital employed during the latest financial year. Profits are variable, and another of the problems of the standard PE or earnings yield is that if a company has an unusually good or unusually bad year it skews the ratio too.

Return is just another word for profit so if a company earns an average return of 10% on £100 million capital, its normalised profit would be £10 million.

The earnings yield is, therefore, normalised profit as a percentage of enterprise value.

If you think that is an extravagant way to calculate the earnings yield, it is translated into a score from -2 to 1 using the formula for the decidedly luxurious sigmoid curve.

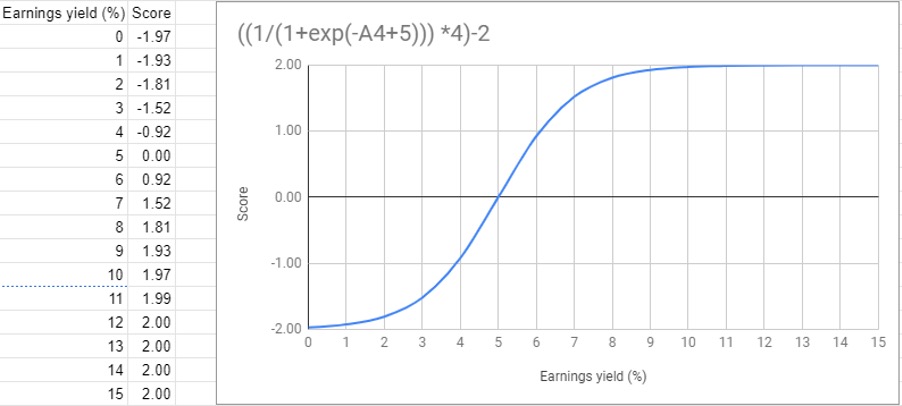

This is the curve I have been using. For any given earnings yield, the formula for the curve spits out a price score between -2 and 2:

This is the new curve. For any given earnings yield, the formula for the curve spits out a price score between -2 and 1:

These seductive curves make me look very intelligent but, just to disabuse you, I should remind you of their origin story.

I could visualise what kind of curve I needed but had no idea how to derive the formula so I drew it on a piece of a paper, shared it with a WhatsApp group of mates with maths degrees and set them the problem.

Nine shares for the future

As you know, since last month I have changed the way the Decision Engine scores price. I have also updated my analyses of Bunzl (LSE:BNZL), RM (LSE:RM.), and Quartix (LSE:QTX).

Generally I consider shares scoring seven or more out of nine to be particularly attractive, but I am happy to own shares that score five or more.

These are the scores on the doors...

0 | Name | Description | Ticker | Total |

1 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 8 | ||

2 | Manufactures pushbuttons and other components for lifts and ATMs | 8 | ||

3 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 8 | ||

4 | Manufactures power adapters for industrial and healthcare equipment | 7 | ||

5 | Retails clothes and homewares | 7 | ||

6 | Manufactures military tech. Does research and consultancy | 7 | ||

7 | Supplies kitchens to small builders | 7 | ||

8 | Imports and distributes timber and timber products | 7 | ||

9 | Distributes essential everyday items consumed by organisations | 7 | ||

10 | Makes light fittings for commercial and public buildings, roads, and tunnels | 6 | ||

11 | Develops and integrates Customer Data Platforms | 6 | ||

12 | Manufactures filters and filtration systems for fluids and molten metals | 6 | ||

13 | Manufactures personal care and beauty brands | 6 | ||

14 | Acquires and operates small scientific instrument manufacturers | 6 | ||

15 | Manufactures natural animal feed additives | 6 | ||

16 | Manufactures/retails Warhammer models, licenses stories/characters | 6 | ||

17 | Supplies vehicle tracking systems to small fleets and insurers | 6 | ||

18 | Manufactures rugged computers, battery packs, radios. Distributes electronics | 6 | ||

19 | Sells promotional materials like branded mugs and tee shirts direct | 6 | ||

20 | Supplies software and services to the transport industry | 6 | ||

21 | Supplies schools with equipment and IT, and exam boards with e-marking | 6 | ||

22 | Manufactures and distributes nuts and bolts, screws, and rivets | 6 | ||

23 | Manufactures vinyl flooring for commercial and public spaces | 6 | ||

24 | Flies holidaymakers to Europe, sells package holidays | 6 | ||

25 | Translates documents and localises software and content for businesses | 6 | ||

26 | Manufactures tableware for restaurants and eateries | 6 | ||

27 | Whiz-bang manufacturer of automated machine tools and robots | 5 | ||

28 | Sources, processes and develops flavours esp. for soft drinks | 5 | ||

29 | Sells hardware and software to businesses and the public sector | 5 | ||

30 | Manufactures specialist paper, packaging and high-tech materials | 5 | ||

31 | Develops marketing automation software | 5 | ||

32 | Designs recording equipment, loudspeakers, and instruments for musicians | 5 | ||

33 | Manufactures disinfectants for simple medical instruments and surfaces | 5 | ||

34 | Manufactures connectivity components and power cord | 5 | ||

35 | Casts and machines parts for vans and trucks, primarily | 5 | ||

36 | Designs and manufactures tableware, candles and reed diffusers | 5 | ||

37 | Publishes books and online resources for academics and professionals | 5 | ||

38 | Operates tenpin bowling centres | 5 | ||

39 | Manufactures respiratory protection equipment and body armour | 4 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports. Due to a change in the way the price criterion is calculated, share price movements and updates, scores may differ from scores in the linked profiles.

Richard owns shares in many Decision Engine shares, especially those in the top half of the list.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor. Richard owns shares in many Decision Engine shares, especially those in the top half of the list.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.