Share Sleuth: the long-term winner I’ve bought more of

Last month, Richard Beddard mulled buying more shares in one of his long-term positions but has now hit the buy button. Here, he explains why.

12th January 2026 09:03

by Richard Beddard from interactive investor

Thanks to the Christmas holiday, this month I had only one opportunity to consider trades. It was on Wednesday 6 January.

About 4% of the Share Sleuth portfolio was cash, above my minimum trade size of 2.5 of its total value. Consequently, additions as well as disposals were in the frame.

- Invest with ii: Top UK Shares | Free Regular Investing | Open an investment Account

This is how the top-ranked shares in the Decision Engine lined up:

# | company | description | score | qual | price | ih% | ss% | ih%-% |

1 | FW Thorpe | Makes lighting systems for commercial, industrial and public settings | 9.0 | 0.8 | 9.6% | 8.3% | 1.3% | |

2 | Howden Joinery | Supplies kitchens to small builders | 8.0 | 0.6 | 7.2% | 5.9% | 1.3% | |

3 | James Latham | Distributes imported panel products, timber, and laminates | 7.5 | 1.0 | 7.0% | 5.3% | 1.7% | |

4 | Bunzl | Distributes essential everyday items consumed by organisations | 7.5 | 0.7 | 6.3% | 4.1% | 2.2% | |

5 | Renew | Maintains and improves road, rail, water, and energy infrastructure | 7.5 | 0.6 | 6.1% | 5.6% | 0.5% | |

6 | Softcat | Sells software and hardware to businesses and public sector | 7.5 | 0.5 | 6.1% | 4.5% | 1.6% | |

7 | Jet2 | Package tour operator and leisure airline | 8.0 | 7.0 | 1.0 | 5.9% | 5.8% | 0.2% |

8 | Solid State | Manufactures electronic systems and distributes components | 7.0 | 0.9 | 5.9% | 3.9% | 2.0% | |

9 | Cohort | Manufactures/supplies defence tech, training, consultancy | 8.0 | -0.3 | 5.3% | 1.5% | 3.8% | |

10 | Hollywood Bowl | Operates tenpin bowling centres | 7.5 | 0.1 | 5.3% | 2.6% | 2.7% | |

11 | Churchill China | Manufactures tableware for restaurants etc. | 6.5 | 1.0 | 5.0% | 2.4% | 2.6% |

The Decision Engine calculates ideal holding sizes (ih%) based on the scores I have given shares (click on the score for a particular share to see how I scored it). It then compares the actual portfolio holding size (ss%) to the ideal holding size (ih%-%) to determine whether the share is under, or over-represented in the portfolio. If the difference is greater than 2.5%, the minimum trade size, it recommends a trade. For more detail on these calculations, please see my recent explainer.

The eight highest-ranked shares in the Decision Engine were fully represented, but the ninth, 10th and 11th were under-represented. Consequently, they were prime candidates for investment.

In fact, I got no further than Cohort (LSE:CHRT), the highest ranked and most under-represented share of three. It is a mini defence-technology conglomerate that I ummed and ahhed about mightily last month. Ultimately, I decided not to add more shares. Cohort’s immediate outlook was mixed, the directors had sold large amounts of shares in the summer, and the half-year results were imminent.

That proved to be a lucky decision, because the results precipitated a further decline in the share price.

Cohort: make your mind up time

Since I first added Cohort to the portfolio in June 2012, my trades have been well timed (a “b” in the chart indicates an addition to the holding and an “s” indicates a reduction). I am hoping to continue this trend, but beware, I am not always so adept at market timing.

Cohort published its half-year results in December, so we have new information. The company will provide more context in presentations on 12 January and 14 January, after I file this article but maybe before you read it. I based my decision on the results alone.

There are many moving parts to Cohort. Revenue improved over the previous half-year but profit declined slightly. The main detractors were MCL and ELAC Sonar.

MCL is a reseller of defence technology, and its revenues are lumpy, so periods of poor performance are to be expected. Last year MCL did very well and it probably will again.

ELAC Sonar manufactures sonar systems. It is currently supplying a large order to the Italian navy, which is equipping four new submarines. Throughout 2024 and 2025, Cohort has indicated that its accounting might prove conservative as the project moves through the design phase. Margins will improve if it costs less to deliver the hardware than the company has allowed for.

The first submarine system is nearing completion and Cohort has previously indicated the first hardware deliveries will be in the current financial year (ending in August). Maybe in the full-year results we will discover whether the accounting has been conservative. That being the case, I think margins should start to improve, to reflect actual costs.

Cohort’s newest acquisition, EM Solutions, made its first contribution. It makes mobile satellite communications terminals, mainly for navies. I was somewhat sceptical about the large size of this acquisition when I last scored Cohort, but EM’s profit margin before joining Cohort was decent. The company disclosed “particularly good [order] intake” at EM in the half-year results.

Overall, Cohort expects revenue and profit to increase over the full year, although whether it will have grown absent newly acquired EM Solutions remains to be seen.

I was nervous about buying the dip, lest it prove to be a bigger trough. But I think it may well be a good time to buy Cohort shares and the portfolio has the cash, so that is what I did.

On Wednesday 6 January, I added 510 shares in Cohort at a price, quoted by a broker, of £10.17. After deducting £10 in lieu of fees, the cost was just shy of £5,197.

There is now insufficient money to fund additions so my attention will turn to reductions and liquidations. There is only one obvious candidate for reduction, high-flying Goodwin (LSE:GDWN), the only share that is over-represented in the portfolio:

# | company | description | score | qual | price | ih% | ss% | ih%-% |

26 | Goodwin | Casts and machines steel and processes minerals for niche markets | 8.5 | -2.1 | 2.8% | 6.5% | -3.7% |

There are a number of weaker businesses that score 6 or 6.5 out of 9 for quality in the Share Sleuth portfolio. These candidates for liquidation are, from lowest ranked to highest ranked: Macfarlane Group (LSE:MACF), Focusrite (LSE:TUNE), Advanced Medical Solutions Group (LSE:AMS), Oxford Instruments (LSE:OXIG) and Churchill China (LSE:CHH).

These, though, are decisions for next month. Having placed multiple trades a month in 2025 as I reconfigured the Share Sleuth portfolio guided by the newly reconfigured Decision Engine, I am hopeful of a more leisurely one trade a month routine for most of the months in the future.

Share Sleuth performance

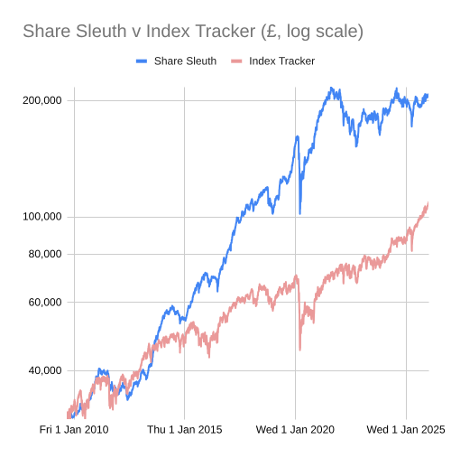

At the close on 7 January, Share Sleuth was worth £208,494, 595% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth 108,900, an increase of 263%.

Past performance is not a guide to future performance.

After trades and dividends paid during the month from Bunzl (LSE:BNZL), Focusrite (LSE:TUNE), Renishaw (LSE:RSW), and Softcat (LSE:SCT), Share Sleuth’s cash pile is £2,380.

The minimum trade size, 2.5% of the portfolio’s value, is £5,212.

Share Sleuth, 07 Jan 2026 | Cost (£) | Value (£) | Return (%) |

Cash (1% of portfolio) | 2,380 | ||

Current holdings (24 shares) | 206,114 | ||

Total, and performance since 9 September 2009 | 30,000 | 208,494 | 595 |

Benchmark: FTSE All-Share index tracker (acc) | 30,000 | 108,900 | 263 |

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

AMS | Advanced Medical Solutions | 1,965 | 4,503 | 4,352 | -3 |

ANP | Anpario | 1,124 | 4,057 | 5,339 | 32 |

BMY | Bloomsbury | 1,882 | 8,354 | 8,996 | 8 |

BNZL | Bunzl | 417 | 9,798 | 8,473 | -14 |

BOWL | Hollywood Bowl | 1,972 | 4,971 | 5,354 | 8 |

CHH | Churchill China | 1,495 | 17,228 | 4,963 | -71 |

CHRT | Cohort | 836 | 6,315 | 8,611 | 36 |

FAN | Volution | 830 | 5,151 | 5,395 | 5 |

FOUR | 4Imprint | 116 | 2,251 | 4,704 | 109 |

GAW | Games Workshop | 66 | 4,116 | 12,177 | 196 |

GDWN | Goodwin | 58 | 1,403 | 13,572 | 867 |

HWDN | Howden Joinery | 1,476 | 10,371 | 12,391 | 19 |

JET2 | Jet2 | 822 | 5,211 | 11,681 | 124 |

LTHM | James Latham | 1,150 | 14,437 | 11,098 | -23 |

MACF | Macfarlane | 7,689 | 10,011 | 5,536 | -45 |

OXIG | Oxford Instruments | 505 | 10,044 | 11,034 | 10 |

PRV | Porvair | 906 | 4,999 | 7,647 | 53 |

QTX | Quartix | 1,618 | 3,988 | 4,611 | 16 |

RNWH | Renew Holdings | 1,310 | 9,804 | 11,738 | 20 |

RSW | Renishaw | 234 | 6,227 | 8,693 | 40 |

SCT | Softcat | 675 | 9,995 | 9,450 | -5 |

SOLI | Solid State | 5,009 | 6,033 | 8,390 | 39 |

TFW | Thorpe (F W) | 6,153 | 14,861 | 16,859 | 13 |

TUNE | Focusrite | 2,020 | 14,128 | 5,050 | -64 |

Notes:

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

Objective: To beat the index tracking fund handsomely over five year periods

Source: ShareScope.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns all the shares in the Share Sleuth portfolio.

For more on the Decision Engine and Share Sleuth, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.