Shares for the future: ranked for the first time

Our companies analyst has been busy researching new companies and re-scoring old favourites.

31st July 2020 14:08

by Richard Beddard from interactive investor

Our companies analyst has been busy researching new companies and re-scoring old favourites.

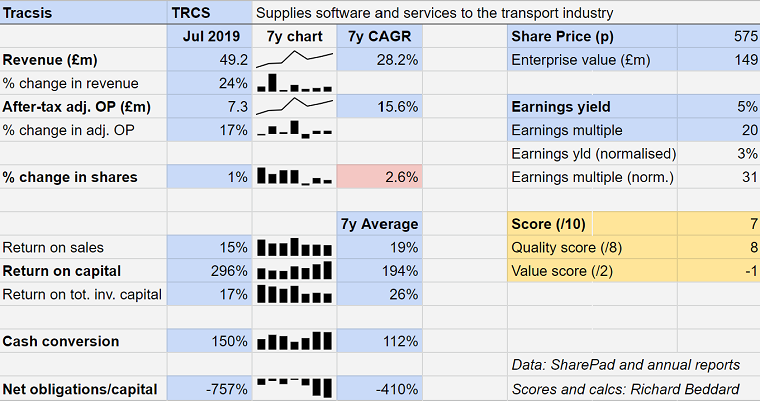

March seems like a very long time ago. The Covid-19 pandemic had only just been declared when I decided Tracsis (LSE:TRCS) was my kind of company. I didn’t score it then because I was not ready to. The pandemic was playing with my mind, and I had only just got to know the business.

In June, I edged a bit closer to commitment after examining seven years of Tracsis. Today, I’m scoring it, and shuffling it into the Decision Engine, so we can see how it ranks compared to all the other shares I follow closely.

Scoring Tracsis

Tracsis is a collection of businesses. The original one, founded in 2004 and floated in 2007, developed and marketed crew-scheduling software. It was the seed of Tracsis’ Rail division.

The Rail division has diversified through acquisition. It is the most profitable of Tracsis’ two divisions and is also proving to be its most resilient, thanks to recurring software revenue and large multi-year projects. Despite the pandemic, in May Tracsis reported it had won two new big contracts, one for the TRACS Enterprise suite, which brings many of the division’s software products together, and another for Remote Condition Monitoring systems, trackside systems that monitor the condition of railway track and predict failure. Earlier this month the company reported that it is trading well and has good prospects.

Tracsis’ second division, Traffic and Data Services earned more revenue in the year to July 2019 than Rail, but less profit. In the year about to conclude, it may well earn less revenue than Rail and will certainly earn far less profit. Also largely a collection of acquisitions, Traffic and Data Services’ two most significant activities were hit badly by the pandemic. There was less demand for traffic surveys because there were abnormally low levels of traffic on our roads so the data would not have been very useful. Event traffic management dried up because there were no events and therefore no parking or admissions to sort out.

The company reports in November and says revenue will be about £46 million, maybe 7% lower than 2019. Given that Rail is more profitable and doing well, and a combination of corporate cost management and government support will have limited the damage at Traffic and Data Services, we can hope for a reasonably resilient outcome.

Looking ahead, traffic has returned to our roads, but events have yet to return to our calendars. Event management was responsible for about 20% of Tracsis’ revenue in 2019, and it remains to be seen how the company adapts to the new normal. A profitable rail division and hefty cash surplus (£16 million in July) give it time.

Tracsis’ historical numbers are very good.

The company has grown through innovation, acquisition, and international expansion. It buys successful niche businesses and retains the managers, augmenting its own products and services and selling acquired ones more widely. Judging by its 17% return on total invested capital, the strategy is successful. Notably, it has largely funded acquisitions with its own cash flows.

While the Rail division appears to have a number of competitive advantages, principally its intellectual property and the recurring revenues it generates, the Traffic and Data services side is more mundane and customers’ ad-hoc demand has been exposed during the pandemic. Even here though, there seems to be opportunities to add more automation.

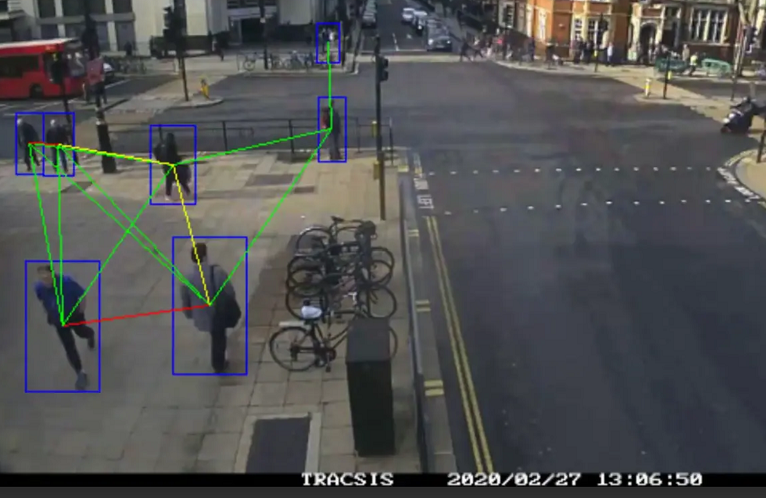

Currently the company is touting artificial intelligence and analytics for measuring social distancing on streets and platforms. It is hoping councils will use them to plan road changes and encourage pedestrians and cyclists.

Tracsis uses artificial intelligence to measure social distancing. Source:https://tracsistraffic.com

I like Tracsis, this is how much...

Profitability: Does the business make good money? [2]

+ Return on capital is very high

+ Profit margins are high

+ Cash conversion is very good

Risks: What could stop it growing profitably? [2]

+ Very strong finances

? Large customers (biggest 18%)

? Traffic and Data is less special than Rail

Strategy: How does its strategy address the risks? [2]

+ Using technology in Traffic & Data

+ Specialised acquisitions add value

? Overseas expansion has been slow

Fairness: Will we all benefit? [2]

+ “Relaxed” culture

+ Executive remuneration reasonable and straightforward

? Founder only involved as as adviser

Valuation: Are the shares cheap? [-1]

? 595p values the enterprise at £155m, 21 times adjusted 2019 profit

? But 2019 was a good year

˗ Normalised PE is about 32

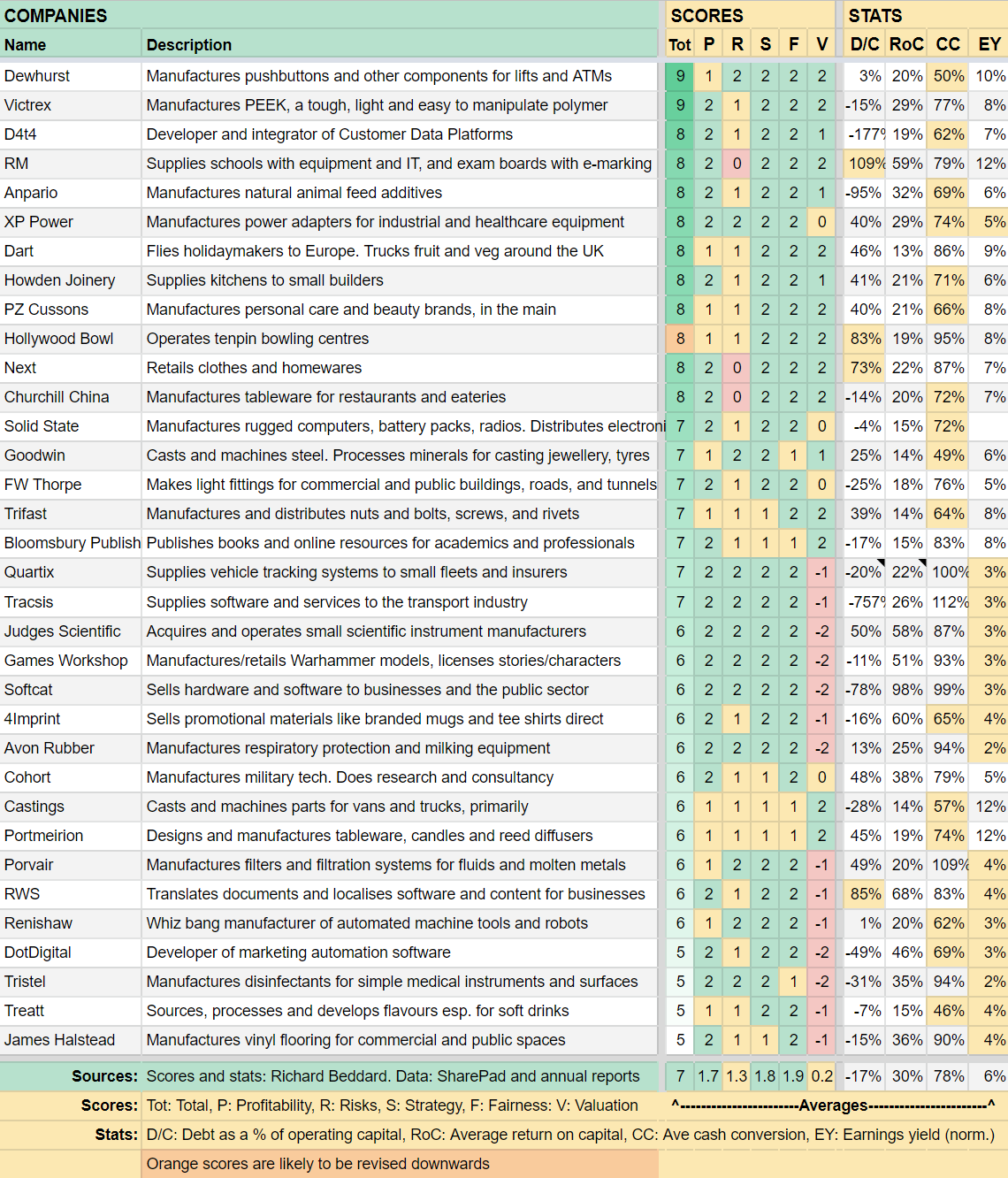

I am still getting to know Tracsis. It scores 7/10 and I think it probably is a good long-term investment. It is ranked 19 out of the 34 shares I follow most closely (see below).

Shares for the future

By scoring companies I hope to identify shares that will make good long-term investments even though they may not be performing so well in the short-term.

The Decision Engine ranks all the shares I follow closely according to their scores. Shares near the top of the list are the most attractive but I would not bother following any of these shares if I did not think they were likely to be good long-term investments.

As well as scoring Tracisis for the first time, I have added another new company, D4t4 (LSE:D4T4), to the Decision Engine since last month’s update and re-scored Castings (LSE:CGS) and Solid State (LSE:SOLI) after they recently published annual reports.

You can see how I scored each share by following the links in the table below:

| Name | Description | Profile |

|---|---|---|

| 4imprint (LSE:FOUR) | Sells promotional materials like branded mugs and tee shirts direct | https://bit.ly/swFOUR2020 |

| Anpario (LSE:ANP) | Manufactures natural animal feed additives | https://bit.ly/swANP2020 |

| Avon Rubber (LSE:AVON) | Manufactures respiratory protection and milking equipment | https://bit.ly/swBMY2020 |

| Bloomsbury Publishing (LSE:BMY) | Publishes books and online resources for academics and professionals | http://bit.ly/swBMY2019 |

| Castings (LSE:CGS) | Casts and machines parts for vans and trucks, primarily | https://bit.ly/swCGS2020 |

| Churchill China (LSE:CHH) | Manufactures tableware for restaurants and eateries | https://bit.ly/swCHH2020 |

| Cohort (LSE:CHRT) | Manufactures military tech. Does research and consultancy | http://bit.ly/swCHRT2019 |

| D4t4 (LSE:D4T4) | Developer and integrator of Customer Data Platforms | https://bit.ly/swD4T42020 |

| Dart (LSE:DTG) | Flies holidaymakers to Europe. Trucks fruit and veg around the UK | http://bit.ly/swDTG2019 |

| Dewhurst (DWHT) | Manufactures pushbuttons and other components for lifts and ATMs | http://bit.ly/swDWHT2020 |

| dotDigital (LSE:DOTD) | Developer of marketing automation software | http://bit.ly/swDOTD2019 |

| FW Thorpe (LSE:TFW) | Makes light fittings for commercial and public buildings, roads, and tunnels | http://bit.ly/swTFW2019 |

| Games Workshop (LSE:GAW) | Manufactures/retails Warhammer models, licenses stories/characters | http://bit.ly/swGAW2019 |

| Goodwin (LSE:GDWN) | Casts and machines steel. Processes minerals for casting jewellery, tyres | http://bit.ly/swGDWN2019 |

| Hollywood Bowl (LSE:BOWL) | Operates tenpin bowling centres | http://bit.ly/swBOWL2020 |

| Howden Joinery (LSE:HWDN) | Supplies kitchens to small builders | http://bit.ly/sw2020HWDN |

| James Halstead (LSE:JHD) | Manufactures vinyl flooring for commercial and public spaces | http://bit.ly/swJHD2019 |

| Judges Scientific (LSE:JDG) | Acquires and operates small scientific instrument manufacturers | https://bit.ly/swJDG2020 |

| Next (LSE:NXT) | Retails clothes and homewares | https://bit.ly/swNXT2020 |

| Portmeirion (LSE:PMP) | Designs and manufactures tableware, candles and reed diffusers | https://bit.ly/swPMP2020 |

| Porvair (LSE:PRV) | Manufactures filters and filtration systems for fluids and molten metals | http://bit.ly/swPRV2019 |

| PZ Cussons (LSE:PZC) | Manufactures personal care and beauty brands, in the main | http://bit.ly/swPZC2019 |

| Quartix (LSE:QTX) | Supplies vehicle tracking systems to small fleets and insurers | https://bit.ly/swQTX2020 |

| Renishaw (LSE:RSW) | Whiz bang manufacturer of automated machine tools and robots | http://bit.ly/swRSW2019 |

| RM (LSE:RM.) | Supplies schools with equipment and IT, and exam boards with e-marking | http://bit.ly/swRM2020 |

| RWS (LSE:RWS) | Translates documents and localises software and content for businesses | https://bit.ly/swRWS2020 |

| Softcat (LSE:SCT) | Sells hardware and software to businesses and the public sector | http://bit.ly/swSCT2019 |

| Solid State (LSE:SOLI) | Manufactures rugged computers, battery packs, radios. Distributes electronics | https://bit.ly/swSOLI2020 |

| Tracsis (LSE:TRCS) | Supplies software and services to the transport industry | (this article) |

| Treatt (LSE:TET) | Sources, processes and develops flavours esp. for soft drinks | http://bit.ly/swTET2020 |

| Trifast (LSE:TRI) | Manufactures and distributes nuts and bolts, screws, and rivets | http://bit.ly/swTRI2019 |

| Tristel (LSE:TSTL) | Manufactures disinfectants for simple medical instruments and surfaces | http://bit.ly/swTSTL2019 |

| Victrex (LSE:VCT) | Manufactures PEEK, a tough, light and easy to manipulate polymer | http://bit.ly/swVCT2020 |

| XP Power (LSE:XPP) | Manufactures power adapters for industrial and healthcare equipment | https://bit.ly/swXPP2020 |

Richard owns shares in most of the companies listed in the Decision Engine.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.