These 32 stocks are ‘clear winners’ from the corona crisis

A team of city analysts name the companies they think will emerge stronger post Covid-19.

21st April 2020 15:23

by Graeme Evans from interactive investor

A team of city analysts name the companies they think will emerge stronger post Covid-19.

Heavily-sold shares in JD Sports Fashion (LSE:JD.), Auto Trader (LSE:AUTO) and Paragon Banking Group (LSE:PAG) were today among 32 stocks backed by a City firm to “survive and thrive” in the Covid-19 markets crisis.

Peel Hunt's list of companies it expects to emerge from the pandemic with stronger market positions and growth prospects covers 11 sectors, with Bodycote (LSE:BOY) and Avon Rubber (LSE:AVON) among the industrials and Dunelm (LSE:DNLM) and ASOS (LSE:ASC) the other two stocks from the retail category.

The broker uses seven themes to determine its “clear winners”, including balance sheet strength, technology adoption and potential exposure to significantly increased government spending. It also looks for companies focused on opportunity rather than survival.

- Invest with ii: Top UK Shares | Super 60 Investment Ideas | Open a Trading Account

This means there's room for two of the market's most robust performers so far this year — pharmaceuticals company Hikma Pharmaceuticals (LSE:HIK) and retail technology stock Ocado (LSE:OCDO). They've risen by 16% and 25% respectively so far in 2020, with Peel Hunt eyeing further growth.

Today's note backed Hikma shares to climb to 2,380p due to the company's importance as a secure source of essential medicines in the United States. The Covid-19 crisis is also set to

to increase focus on local security of pharmaceutical supply for years to come.

On Ocado, the note said the current crisis should heighten demand from retailers for the company's “flexible and scalable” online logistics solutions. Shares are backed to extend the 25% rise seen so far this year by climbing to 1,700p.

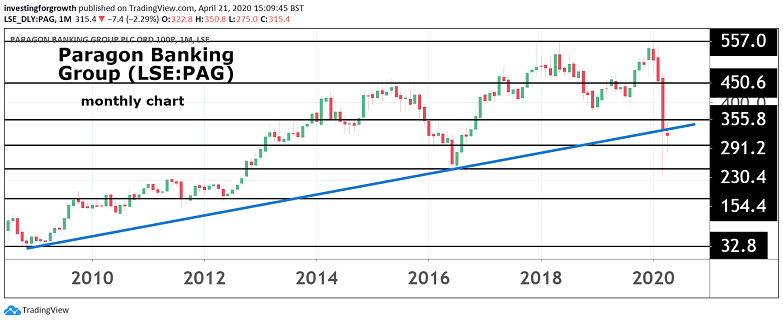

Source: TradingView Past performance is not a guide to future performance

Among stocks to have fallen sharply in 2020, Peel Hunt thinks that JD Sports can rebound in spectacular fashion from last night's 494p, having fallen 41% in 2020. Its price target of 900p would return the highly-rated stock to the record-breaking levels seen in February.

The broker said: “JD Sports has built itself an enviable position in the global sports fashion market and will emerge stronger from the crisis.” The note said JD now had a seat at the global table thanks to its US acquisition of Finish Line and strong relationships with Nike and Adidas.

Elsewhere in retail, ASOS shares are backed to reach 3,000p after its recent share placing provided enough headroom to both withstand the crisis and develop expansion plans. On Dunelm, Peel Hunt expects the homewares business to accelerate its 8.5% market share materially as consumers embrace a new online platform and as it exploits weaker rivals.

- Oil share analysis and Covid-19 stock round-up

- A checklist for finding dividend shares in a crisis

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Auto Trader (LSE:AUTO) is also backed to recover from a difficult 2020, with the company's market position and insight set to be of real value once used car sales restart following the lockdown.

A recent fundraising has extinguished debt and armed the company for M&A should opportunities arise, Peel Hunt said. A price target of 545p would take Trader back to mid-February levels.

The broker sees shares in specialist lender Paragon as one of the biggest potential winners from any Covid-19 markets recovery, with a price target of 600p compared with last night's 323p.

Today's note said: “As a likely survivor, it should benefit from expected stronger margins after Covid-19.” Paragon has a strong position in professional buy-to-let mortgages, with the vast majority of lending on a secured basis and with prudent loan-to-value ratios.

The three other stocks in the financial sector with buy recommendations are Impax (LSE:IPX), IntegraFin (LSE:IHP) and Manolete (LSE:MANO).

Source: TradingView Past performance is not a guide to future performance

Peel Hunt said the industrials landscape will see huge change as a result of the pandemic, but out of this will also create opportunity. In particular, it notes the potential for Avon Rubber (LSE:AVON) as the global market leader in respiratory protection for military and first-aid responders.

Its shares have already risen 25% this year, but are tipped to increase from the current 2,620p to 3,330p. On Bodycote, Peel Hunt noted that the heat treatment firm's competition was made up of local private companies that might not last a protracted crisis. This would provide the opportunity to acquire high-class assets in an industry where meaningful M&A is rare.

Bodycote, which is in the interactive investor Aggressive Winter Portfolio, is tipped to rise from 582p to 800p. The third industrials stock on the list is performance materials business Coats.

The other stocks to watch on Peel Hunt's “clear winners” list include consumer-focused Hilton Foods (LSE:HFG) and Inspecs (LSE:SPEC), real estate firms Assura (LSE:AGR), PHP (LSE:PHP), LondonMetric (LSE:LMP), Segro (LSE:SGRO) and Warehouse REIT (LSE:WHR), and technology trio Boku (LSE:BOKU), Gamma (LSE:GAMA) and Softcat (LSE:SCT). In support services, the four stocks to note are Balfour Beatty (LSE:BBY), Rentokil Initial (LSE:RTO), Serco (LSE:SRP) and Speedy Hire (LSE:SDY).

The list is made up of healthcare firm Abcam (LSE:ABC), paving supplies business Marshalls (LSE:MSLH), corporate merchandise firm 4imprint (LSE:FOUR), ventilation supplier Volution (LSE:FAN) and delivery firm Domino's Pizza (LSE:DOM).

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.