The 20 most-popular AIM stocks of 2025

Lots of exciting stories have generated great interest in AIM stocks over the past year, in some cases triggering gains of 1,000% or more. Award-winning AIM writer Andrew Hore runs through the top 20.

30th December 2025 12:03

by Andrew Hore from interactive investor

Trading levels on AIM have been recovering this year and, although liquidity can vary sharply, there are plenty of AIM companies that attract the attention of investors and have significant amounts of shares traded.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

In the table below are the 20 most-popular AIM companies on the interactive investor platform in terms of share buys during 2025. Eight of the 20 companies were in the list when we ran the same data three years ago.

Oil and gas company i3 Energy has been taken over, fuel cells developer Ceres Power moved to the Main Market and COPD treatments developer Synairgen chose to leave AIM. The other nine no longer in the list are still quoted on AIM.

Nine of the top 10 in this year’s list and 15 out of the top 20 are natural resources companies. Ten of those are miners, four oil and gas companies and the other is helium explorer Helium One Global Ltd Ordinary Shares (LSE:HE1).

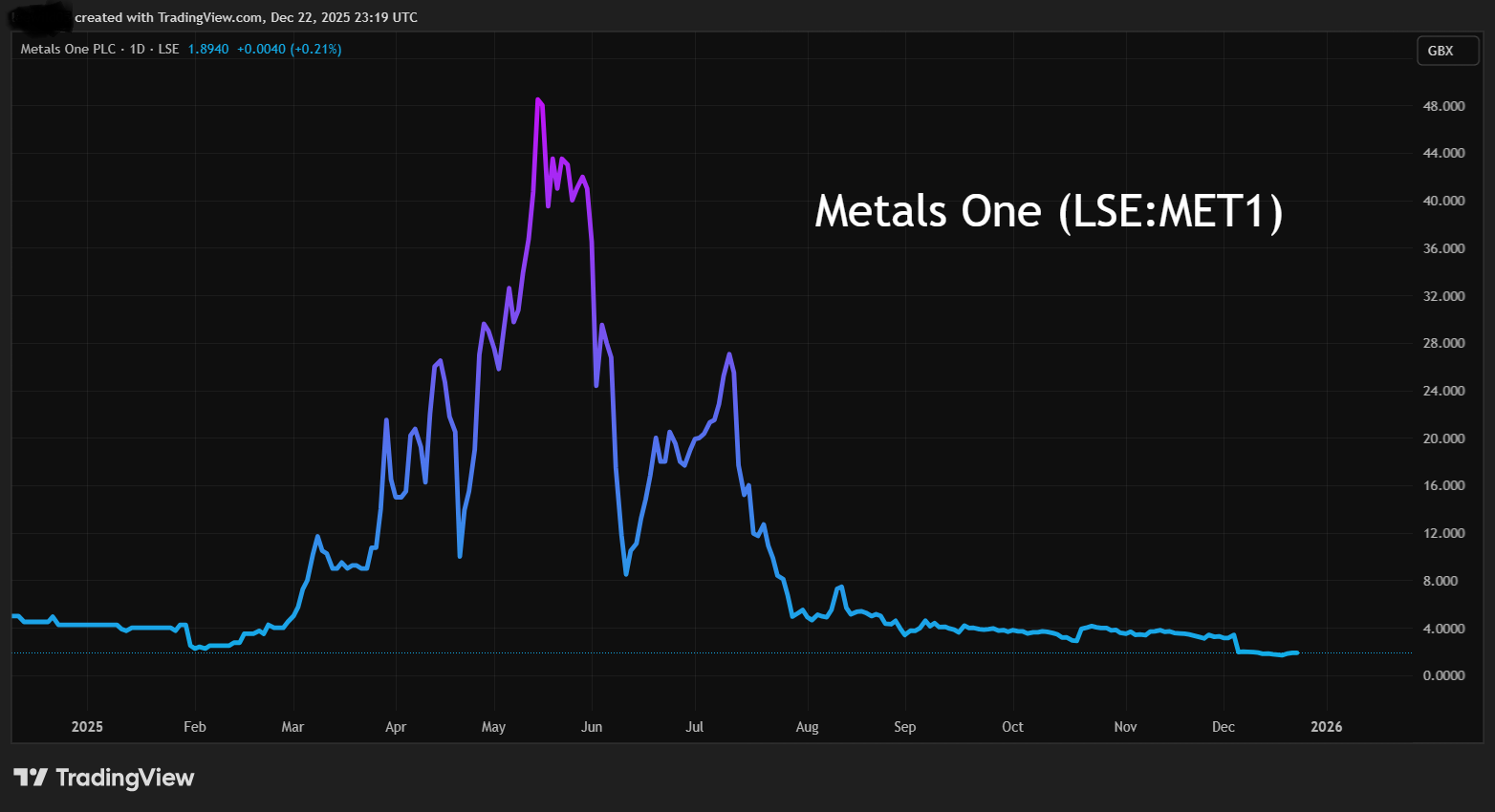

Metals explorer Metals One (LSE:MET1) is by far the most popular AIM share last year. It is a good example of how a relatively illiquid share can catch the attention of investors and become highly liquid.

In January, there were 239 trades in total, not just via interactive investor, and they were worth £100,000. By May and June, Metals One was the most traded company on AIM.

In July, the number of trades peaked at 141,081 and were valued at £209.3 million. The 53,502 trades in Jet2 Ordinary Shares (LSE:JET2) made it second in July, although the trades were worth more.

To put this in perspective this came after the share price had fallen back from its high of 48p in May to 19p at the end of June, which valued Metals One at £53.2 million. That means that nearly four times the starting valuation were traded during the month. In contrast, less than one-fifth of the market capitalisation of Jet2 was traded.

- Investment outlook: expert opinion, analysis and ideas

- AIM’s biggest companies and how they performed in 2025

- Jet2: shares for the future: what 2026 might hold for this top 5 stock

Airline and tour operator Jet2 has consistently been one of the most traded AIM companies in recent years and is in this top 20 list. It is also the second-largest company on AIM.

Metals One and Jet2 remained the top two in August and, although Metals One is no longer the most traded share on AIM, it has remained in the top 20.

At the peak, the share price was more than 1,000% higher, but by the end of the year it was three-fifths lower. This takes account of a 10-for-1 share consolidation in March.

Source: TradingView. Past performance is not a guide to future performance.

The interest in Metals One started to pick up momentum when it announced the conditional acquisition of the Lillefjellklumpen project in central Norway. This project has platinum group elements, gold, nickel and copper. The acquisition of uranium projects also boosted interest. There have also been investments in many other projects.

Metals One is raising £4.4 million at 2p/share and the cash will be spent on Lions Bay Resources, where it recently acquired an interest in convertible loan notes for up to $1.8 million. Lions Bay Resources plans to refurbish a cogeneration plant in South Africa, which will be used to generate power and roast refractory gold concentrates.

Most-bought AIM stocks on the ii platform in 2025

1 | |

2 | |

3 | |

4 | |

5 | |

6 | |

7 | |

8 | |

9 | |

10 | |

11 | |

12 | |

13 | |

14 | |

15 | |

16 | |

17 | |

18 | |

19 | |

20 |

Source: interactive investor as at 16 December 2025.

Greatland Gold is the second most traded company, and it was readmitted to AIM as Greatland Resources Ltd (LSE:GGP), which is also on the list, on 23 June 2025. That was after the company redomiciled to Australia and acquired the 70% of the Havieron gold copper project in Australia previously owned by Newmont Corporation. It also raised £30 million at 312p/share. Greatland Resources is the 13th most bought share.

A feasibility study shows Havieron having a net present value calculated using a 5% discount rate (NPV5%) of £2.9 billion. Greatland Resources is already a gold producer, with production guidance of 260,000-310,000 ounces for the year to June 2026. Net cash was A$575 million (£284 million) at the end of June 2025, and this will be spent on developing Havieron and other projects.

ITM Power (LSE:ITM) is the third most-traded share in the list, which compares with second in 2022. Three years ago, the trading was part of a continuing slump in the share price that started early in 2021, and buying then was not a successful decision. The share price has risen by 76% this year, but it has still fallen by more than 90% from the high. It is above the 2004 flotation share price of 50p.

ITM Powergenerated interim revenues of £18 million, and cash was £197 million at the end of October 2025. At the end of April 2026, cash should be at least £170 million.

New contract momentum is building up, but many are not going to generate revenues yet. Recently ITM Power was selected as the partner to supply 710 megawatt (MW) of its electrolysers to Stablegrid in Germany. The system will help to stabilise the German electricity system due to variable output from renewable energy. Final investment decision will be in 2028.

Three years ago, fellow fuel cell and electrolyser developers Ceres Power - fourth - and AFC Energy (LSE:AFC) - 12th - were in the top 20. Their share price trends have been similar to ITM Power over the past three years, except the AFC Energy share price has not recovered in 2025.

Other mining stocks

Eurasia Mining (LSE:EUA) is the seventh on the list, having been third three years ago. The Russia-focused mining company has had difficult times since the invasion of Ukraine, but the share price has more than doubled this year.

Trading was particularly strong in February and March, which was a period when there was little in the way of announcements. At the end of March, £3.15 million was raised at 4.37p/share. The share price had peaked at 7.125p a fortnight prior to the fundraising.

On 15 July, Eurasia Mining shares started trading on the Astana International Exchange (AIX) in Kazakhstan. The market maker SQIF Capital Joint Stock Company bought shares traded on AIM to provide liquidity.

Wishbone Gold (LSE:WSBN) is the only company on the list that is quoted on AIM and Aquis. There was a spike in trading in August when the gold explorer revealed that drilling at the Red Setter gold dome project in Western Australia had reached the top of a significant breccia pipe. Later in the month, it raised £1.5 million at 1.25p/share to fund further drilling.

A mineralised strike over 3km has been confirmed for Red Setter. Drilling will complete early in 2026. There are plans to release assay results over the next few months. Management will then formulate a plan for 2026.

On 1 December, Wishbone Gold consolidated 100 shares into one new share.

Of the other mining companies, Empire Metals Ltd (LSE:EEE) is making good progress with the Pitfield project in Western Australia. It has shown the Titanium dioxide (TiO2) that can be produced is high purity. Pitfield has a mineral resource estimate of 2.2 billion tonnes at 5.1% TiO2. Additional exploration is happening. Assay results are due in January.

Premier African Minerals Ltd (LSE:PREM) has been struggling with its processing plant at the Zulu lithium project and is weak financially. Yet, there have been investors optimistic that it can get through its problems. J Goddard Contracting recently demanded immediate payment of $2.3 million (£1.7 million). Total group liabilities are $62.1 million.

Mkango Resources Ltd (LSE:MKA) attracted interest with plans to combine its Songwe Hill rare earths project in Malawi with the Pulawy rare earth separation project in Poland and list them on Nasdaq as Mkango Rare Earths. Mkango Resources estimates that its pro forma shareholding would be valued at $400 million. Joint venture HyProMag USA, a rare earth recycling and processing business, is also planning a listing in the America in around one year’s time.

KEFI Gold and Copper (LSE:KEFI) has secured $240 million of debt capital for the Tulu Kapi gold project. A further $100 million is required for capital investment and this is near to finalisation.

Oil and gas

Pantheon Resources (LSE:PANR) has had a volatile year with mixed drilling news from its oil and gas exploration interests in Alaska. The share price more than doubled early in the year as well tests were due to begin for Megrez-1. There were disappointments from some of these well tests and there are spikes of trading around these announcements.

North Sea-focused oil and gas producer Serica Energy (LSE:SQZ) has been active doing deals during the year, but there have also been production problems that have hit the share price and provided buying opportunities.

Rockhopper Exploration (LSE:RKH) has made the final investment decision on phase 1 of the Sea Lion field, offshore Falkland Islands. Financing is being finalised. Empyrean Energy (LSE:EME) is in dispute with Conrad Asia Energy about its interest in the Duyung PSC in Indonesia. Helium One Global has commenced operations in southern Rukwa in Tanzania ahead of further testing.

Other companies

Regular news concerning orders has meant that Filtronic (LSE:FTC) shares have consistently attracted buyers over the past two years and particularly in 2025. There have also been numerous forecast upgrades.

- FTSE 100’s best and worst shares of 2025

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Space and satellite technology has become increasingly important and rising defence spending is likely to provide further opportunities. SpaceX has been an important customer for high-performance radio frequency (RF) systems technology. The largest order was worth $62.5 million, and the revenues will be recognised in 2026-27 and 2027-28. Airbus is another customer and it is using advanced filter and diplexer assemblies in its satellites. Defence is another growth sector.

ImmuPharma (LSE:IMM) is trying to secure a partner for its P140 treatment for autoimmune diseases. This will not happen until next year. There is enough cash until late 2026. Avacta Group (LSE:AVCT) has announced preliminary phase 1b results in line with the phase 1a data for AVA6000 which shows clinically meaningful tumour shrinkage in salivary gland cancers. This adds to the potential for the company’s preCISION platform.

Catenai (LSE:CTAI) invested in Alludium, which has developed a platform for AI process automation, and gained the attention of investors.

Andrew Hore is a freelance contributor and not a direct employee of interactive investor.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.