Shares for the future: the 31 companies I think are good value

After a month that saw one of his stocks taken over by chocolate bar firm Mars, columnist Richard Beddard runs through some of the thinking behind his new scoring system and names the shares it says are worth owning.

1st December 2023 14:44

by Richard Beddard from interactive investor

It is the turn of the month, and as usual we are publishing the list of shares ranked by my Decision Engine. Each share's score is still determined by my annual evaluation of the business and daily movements in the share price.

Under the hood though, much is changing because I have started to implement a new version of the scoring system. You can read about the new methodology in last month’s Shares for the future article.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

This month, I need to deal with the fallout: how to merge the new and old systems, and make sure they still help me decide how much of each share to hold.

Jury-rigging the Decision Engine

So far, I have scored three companies using the new method, so 37 of the 40 shares in the Decision Engine still have their old scores. They will be re-scored next time they publish an annual report, in up to a year or so’s time.

This gives us a headache, because we are comparing apples with oranges.

Actually, it is more like comparing two different oranges as the two scoring systems do the same thing in a similar way. I expect most shares that scored highly under the old system to do well under the new system and that is how it has worked out so far.

In a few cases, the new system may result in more radical re-evaluation, but that happens occasionally anyway.

Mixing the two systems creates technical conundrums, though.

The most obvious is that the maximum score has changed. The old system scored shares out of 9, and the new system scores shares out of 10. That really is comparing apples to oranges.

I have fixed that problem by scaling each old score up by a factor of 1.111, so now they have the same weight as scores out of 10.

Changing the maximum score raises another issue: the benchmark for deciding whether a high quality business is good value or not.

Traditionally, I have regarded shares that score 7 or more as good value, shares that score 5 or 6 as fair value and shares that score less than 5 to be poor value.

These are arbitrary benchmarks, and I intend to leave them where they are. That, though, creates another problem.

Penalising expensive shares

The scores do not just help me decide whether to hold a share, they also help me decide how much of a share to hold. The higher the score, the greater that share should be as a proportion of its total value.

To show why this might be a problem, I need to talk a bit about the price score.

Like many investors I compare price to profit, although I use enterprise value (the value of equity and debt) instead of the more common market capitalisation (the value of equity) to put a price on the business. I also normalise profit to estimate how much it might earn in a typical year.

This produces a normalised earnings yield (profit in a typical year as a percentage of the firm’s enterprise value). The earnings yield is profit divided by price, and we can translate it back to something that most investors understand using its reciprocal, price divided by profit, the price-to-earnings or PE ratio.

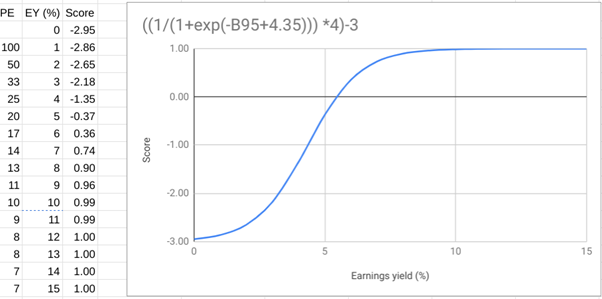

I use a sigmoid function to turn the earnings yield into a score. When plotted, a sigmoid function produces an ‘s’ shaped curve, with the earnings yield on one axis, and the score on the other. The table on the left of the chart shows the more common PE ratio for each earnings yield.

Any share with a PE of less than 10 (an earnings yield of more than 10%) is rewarded with a maximum price score of 1. Between a PE of 17 and a PE 20 (an earnings yield of 5) shares get a score of around 0, and then as the PE rises and the earnings yield falls, shares are penalised by up to a maximum of three points.

This method has the illusion of being scientific, but just in case you think I am a very clever chap, I described the outcome I wanted to some mates who are good at maths, and they gave me the sigmoid function.

Under the rejigged function, shares can score a maximum of 1 and a minimum of -3. Under the old system, shares could score a maximum of 1 and a minimum of -2.

To see why a minimum price score of -2 might be a problem, consider a business of the highest quality. Under the new scoring system it would score 9 for the criteria of dependability, distinctiveness and direction, before the algorithm takes price into account.

That means, even if the share traded on a very high PE of 100, the minimum it could score would be 7 (9 minus 2), which, according to my arbitrary benchmark, is good value.

In other words, the Decision Engine would be telling me to hold a lot of that share at any price.

Since price is a factor in the returns we earn from investments, I do not think we can be so cavalier. With a minimum price score of -3, the minimum overall score for a business of the highest quality stays at 6 (9-3).

How much of a share to hold

Having recalibrated the scoring system, we can use it to determine how much of a share to hold.

The ideal holding size (ihs) is calculated by another formula, which I have also updated to reflect the new maximum score of 10. It is:

ihs = score - (10 - score)

This formula nudges me to hold only 2% of a portfolio in shares scoring 6:

| Score | Ideal holding size (%) |

| 10 | 10 |

| 9 | 8 |

| 8 | 6 |

| 7 | 4 |

| 6 | 2 |

| 5 | 0 |

Living with bias

If one thing jumped out at you from my rather technical explanation, I hope it is that the Decision Engine is not scientific.

I mention this because of an email from a reader, DM, who points out that the results of the Decision Engine are influenced by my own biases.

That, I think, is inevitable, unless we adopt a purely quantitative approach to investing.

Rather than eliminating bias, I am trying to shape and contain it. I am reinforcing good biases, like the focus on quality and value, and reducing potentially harmful biases, principally rushes of blood to the head!

31 shares for the future

I re-score each share in the Decision Engine once a year, after the publication of the annual report.

Since the last update a month ago, Thorpe (F W) (LSE:TFW), PZ Cussons (LSE:PZC) and Renishaw (LSE:RSW) have been through the process. To see how I scored them, please click on the share’s name in the table below.

James Halstead (LSE:JHD), Softcat (LSE:SCT) and YouGov (LSE:YOU) have all published annual reports and are due to be updated.

Generally, I consider shares that score 7 or more out of 10 to be good value. This month there are 31. Shares that score 5 or 6 out of 10 are probably fairly priced.

Sometimes things happen in between reviews that may change a share’s score, but I do not re-score a share until the company publishes its next annual report. This protects me from knee-jerk decisions, ensures I have as much information as possible, and keeps me focused on evaluating one firm at a time.

- How to beat the market: low-risk dividends and how to find them

- Nick Train: the UK stock market has a dividend problem

- FTSE 100 giants have £6bn dividend gift for investors this Christmas

XP Power Ltd (LSE:XPP) and Quartix Technologies (LSE:QTX) fall into this category due to self-inflicted financial difficulties at the power adapter manufacturer, and boardroom changes at the vehicle tracking firm that make me wonder about its strategic direction.

Last month, I suggested I might remove Hotel Chocolat Group (LSE:HOTC) from the Decision Engine and replace it with another idea. That will happen because Mars has made my mind up for me. The giant food conglomerate is taking Hotel Chocolat over.

Despite misgivings about the long-term potential of the share, I am sorry to see Hotel Chocolat lose its independence. It is a distinctive business, and they are in quite short supply.

Company | Description | Score | |

1 | Designs recording equipment, loudspeakers, and instruments for musicians | 10 | |

2 | Manufactures tableware for restaurants and eateries | 10 | |

3 | Supplies kitchens to small builders | 10 | |

4 | Supplies vehicle tracking systems to small fleets and insurers | 9 | |

5 | Manufactures pushbuttons and other components for lifts and ATMs | 9 | |

6 | Translates documents and localises software and content for businesses | 9 | |

7 | Distributor of protective packaging | 9 | |

8 | Manufactures filters and filtration systems for fluids and molten metals | 9 | |

9 | Manufacturer of scientific equipment for industry and academia | 9 | |

10 | Whiz bang manufacturer of automated machine tools and robots | 9 | |

11 | Sources, processes and develops flavours esp. for soft drinks | 9 | |

12 | Makes light fittings for commercial and public buildings, roads, and tunnels | 8 | |

13 | Sells hardware and software to businesses and the public sector | 8 | |

14 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 8 | |

15 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 8 | |

16 | Distributes essential everyday items consumed by organisations | 8 | |

17 | Manufactures/retails Warhammer models, licenses stories/characters | 8 | |

18 | Imports and distributes timber and timber products | 8 | |

19 | Manufactures power adapters for industrial and healthcare equipment | 8 | |

20 | Manufactures natural animal feed additives | 8 | |

21 | Manufactures military technology, does research and consultancy | 8 | |

22 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 8 | |

23 | Makes marketing and fraud prevention software, sells it as a service | 8 | |

24 | Develops and manufactures hygiene, baby, and beauty brands | 7 | |

25 | Online marketplace for motor vehicles | 7 | |

26 | Publishes books, and digital collections for academics and professionals | 7 | |

27 | Sells promotional materials like branded mugs and tee shirts direct | 7 | |

28 | Manufactures vinyl flooring for commercial and public spaces | 7 | |

29 | Flies holidaymakers to Europe, sells package holidays | 7 | |

30 | Online retailer of domestic appliances and TVs | 7 | |

31 | Manufactures rugged computers, battery packs, radios. Distributes electronics | 7 | |

32 | Manufactures sports watches and instrumentation | 6 | |

33 | Collects and analyses market research and opinion polls through online panels | 6 | |

34 | Operates tenpin bowling and indoor crazy golf centres | 6 | |

35 | Retails clothes and homewares | 6 | |

36 | Manufactures specialist paper, packaging and high-tech materials | 5 | |

37 | Supplies software and services to the transport industry | 5 | |

38 | Manufactures disinfectants for simple medical instruments and surfaces | 5 | |

39 | Acquires and operates small scientific instrument manufacturers | 5 | |

40 | Chocolate maker and retailer | 2 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with an asterisk* are more speculative.

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in most of the shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher scoring shares.

More information about Richard’s investment philosophy and how he implements it (this article currently describes the old scoring system, which is similar in principle but different in detail. We will publish a new version in the next Decision Engine update).

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.