Shares for the future: three quality stocks and a new face in town

28th January 2022 15:01

by Richard Beddard from interactive investor

The scores and rank-order of Richard Beddard’s Decision Engine table have changed since he last shared it a month ago. Find out the shares he rates as good long-term investments. He analyses a new stock, too.

I have made no progress with my resolution to be more ruthless about removing weaker companies from the Decision Engine to make way for stronger ones.

Three quality shares

The three existing members I scored in January are not ones I can easily cast off. Apart from their high share prices, I could find very little wrong with Treatt (LSE:TET), a manufacturer of flavours for the drinks industry, and Focusrite (LSE:TUNE), a designer of electronic equipment and software for musicians and venues that play music.

Lift component manufacturer Dewhurst (LSE:DWHT) is equally well managed, but its prospects may be tougher if Covid-19 has accelerated remote working. Dewhurst faces more obvious external risks, but its share price is much lower in relation to normalised profit than the other two.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

To my mind that makes Dewhurst shares attractive, and compensates us for the uncertainty. Dewhurst too will remain a member of the Decision Engine for another year.

As usual you can find out more about these companies, and how I scored them by clicking on their names in the Decision Engine table below.

Introduction to Marks Electrical

One of the companies competing for a place in the Decision Engine is Marks Electrical (LSE:MRK).

Marks Electrical is still run by its founder Mark Smithson, who started the business in 1987. The company sells fridges, washing machines, cookers and TVs. It does not have any showrooms, relying instead on a self-built website and e-commerce system. It only has one warehouse.

This centralisation is what makes it special, allowing it to deliver goods to the most populated parts of the UK in 24 hours in its own vehicles instead of passing them between warehouses and trucks, which takes longer and increases the risk of damage.

The website and delivery are the two main points of contact with customers so these are the capabilities Marks Electrical has focused on. Because its cargoes are large and often need to be installed, delivery is a two person job best done by a trained crew.

- Watch our latest share tips by subscribing for free to the ii YouTube channel

- Read more articles by Richard Beddard here

The company uses its own vehicles and drivers, serviced by its own mechanic. It sells high-end equipment, so the cost of a considerate delivery is offset against the higher purchase price.

You might expect Marks Electrical’s attention to detail when it comes to the customer experience to show through in the reviews on sites like Google and TrustPilot and it does, but another interesting thing about the company is that outside its Midlands base, it is not very well known at all. In March 2021, its market share was 1.2%.

Since the IPO, the company has begun advertising the Marks Electrical brand, to appeal to customers in other regions and particularly London. Judging by the numbers, it may be having an effect.

A few years in numbers

The first stage of inducting a new member into the Decision Engine is to put the historical numbers into the spreadsheet and calculate the ratios that help me decide how good the business is. I export most of them from SharePad, an investment data platform and get the rest from the company’s annual reports.

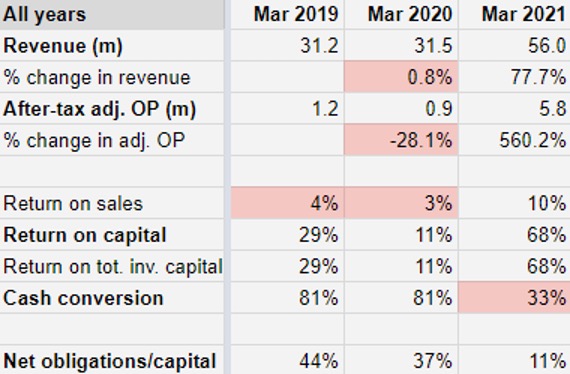

Unfortunately, there are not many numbers for Marks Electrical. It has never published an annual report as a listed company because it floated in November last year. The additional data in my table comes from the Admission Document prepared for the floatation:

Data source: SharePad and Marks Electrical Admission Document. Past performance is not a guide to future performance.

Marks Electrical achieved a massive growth in revenue and profitability during the pandemic. Since the company’s year end last March, it has continued to grow, beating 2021’s revenue of £56 million by December, the ninth month of the financial year.

Growth story

On the face of it, this is an exciting growth story, but the truth is more complicated. The company took business from rivals that closed their stores during the pandemic, but Curry’s and John Lewis have reopened. It does not look like they will be closing again, so competition has returned to the market.

During lockdown buying a washing machine online was the only option, online retailers were selling all the white goods they could and had little need to advertise so the cost of clicks on sites like Google fell sharply. Those have increased now competition has returned.

The company anticipates achieving an EBITDA margin of 9% for the year to March 2022, 3% below the 12% it achieved in 2021 but 4% or 5% above the preceding two years. Costs have increased in comparison to revenue, but the company’s profit margin remains considerably higher than it was before the pandemic (profit margin (aka return on sales) in my table is lower because it includes the cost of depreciation and amortisation).

Probably some of this increased profitability will stick around. People have become more accustomed to buying electrical equipment online and if Marks Electrical earns the £81 million revenue one broker predicts it will be a much bigger and perhaps more efficient operation in 2022 than it was in 2019 when revenue was £32 million.

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

- Our outlook for 2022: key topics and investment ideas for the year ahead

- Check out our award-winning stocks and shares ISA

But there is another uncertainty. Because Marks Electrical has not previously reported the detailed financial disclosures required of listed firms, it is unclear how much revenue and profit will be buffeted by the normal ebbs and flows of the economy.

If it is not an emergency, for example our washing machine has broken down, we can put off buying fridges, cookers and TVs if times are tough, or trade down to cheaper models that are just as costly to deliver but earn the company less revenue.

For this reason it may take some time to get to know Marks Electrical. I am certainly going to wait until its next annual report before attempting to score it, the final stage of induction into the Decision Engine.

There is no hurry. Marks Electrical shares cost only a fraction more than they did when they floated, but that still means they cost 21 times the inflated profits of 2021 and 36 times normalised profit.

Shares for the future, scored and ranked

Two things affect a share’s score, the decisions I make when I score it once a year, and everyday fluctuations in the share price. As a result, the scores and the rank-order of the Decision Engine table have changed since I last shared it a month ago.

As always, I consider all of the shares listed here to be good long-term investments, but the higher up the table they are the more confident I am.

0 | Company | Description | Score |

1 | Manufactures military technology, does research and consultancy | 8 | |

2 | Manufactures pushbuttons and other components for lifts and ATMs | 8 | |

3 | Manufactures personal care and beauty brands | 8 | |

4 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 8 | |

5 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 8 | |

6 | Manufactures power adapters for industrial and healthcare equipment | 8 | |

7 | Supplies kitchens to small builders | 8 | |

8 | Imports and distributes timber and timber products | 7 | |

9 | Designs and manufactures tableware, candles and reed diffusers | 7 | |

10 | Retails clothes and homewares | 7 | |

11 | Manufactures/retails Warhammer models, licenses stories/characters | 7 | |

12 | Manuf's rugged computers, battery packs, radios. Distributes electronics | 7 | |

13 | Publishes books and online resources for academics and professionals | 7 | |

14 | Makes light fittings for commercial and public buildings, roads, and tunnels | 7 | |

15 | Supplies vehicle tracking systems to small fleets and insurers | 7 | |

16 | Designs recording equipment, loudspeakers, and instruments for musicians | 7 | |

17 | Develops and integrates Customer Data Platforms | 6 | |

18 | Acquires and operates small scientific instrument manufacturers | 6 | |

19 | Sources, processes and develops flavours esp. for soft drinks | 6 | |

20 | Manufactures filters and filtration systems for fluids and molten metals | 6 | |

21 | Manufactures natural animal feed additives | 6 | |

22 | Distributes essential everyday items consumed by organisations | 6 | |

23 | Whiz bang manufacturer of automated machine tools and robots | 6 | |

24 | Manufactures tableware for restaurants and eateries | 6 | |

25 | Supplies schools with equipment and IT, and exam boards with e-marking | 6 | |

26 | Translates documents and localises software and content for businesses | 6 | |

27 | Manufacturer of scientific equipment for industry and academia | 6 | |

28 | Manufactures and distributes fasteners and other low cost components | 6 | |

29 | Sells hardware and software to businesses and the public sector | 6 | |

30 | Manufactures specialist paper, packaging and high-tech materials | 6 | |

31 | Sells promotional materials like branded mugs and tee shirts direct | 6 | |

32 | Manufactures disinfectants for simple medical instruments and surfaces | 6 | |

33 | Supplies software and services to the transport industry | 5 | |

34 | Chocolate maker and retailer | 5 | |

35 | Manufactures connectivity components and power cord | 5 | |

36 | Casts and machines parts for vans and trucks, primarily | 5 | |

37 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 5 | |

38 | Manufactures vinyl flooring for commercial and public spaces | 5 | |

39 | Operates tenpin bowling and indoor crazy golf centres | 5 | |

40 | Flies holidaymakers to Europe, sells package holidays | 4 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports.

Shares marked with an asterisk* score less than 5 out of 6 for Profitability, Risks and Strategy. They are more speculative.

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price).

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Dewhurst, Focusrite, Treatt and many of the shares in the Decision Engine table.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.