Shares for the future: a new top five stock

Having warmed to this company, analyst Richard Beddard’s new score propels it seven places further up his list of 30 Decision Engine stocks. Here’s why he likes it so much.

9th January 2026 15:01

by Richard Beddard from interactive investor

I have chosen 2018 as the point from which to measure Renew Holdings (LSE:RNWH) financial performance, because it changed shape that year.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Job done

Having been promoted to chief executive in 2016, a job he retains, Paul Scott was already firmly established. Renew’s current chief financial officer had also been appointed in 2017.

In 2018, they disposed of Forefront and acquired QTS. Loss-making Forefront was a failed acquisition from 2014. It installed and maintained gas mains. QTS is a successful acquisition, the company’s biggest ever, which augmented its already sizable Rail business.

Rail sat in the bigger of Renew’s two business segments, Engineering Services. This division repairs, maintains and improves infrastructure, activities known collectively as “RMI”. At the time, Renew was primarily focused on Road and Rail.

Since 2018, Renew has disposed of less profitable and less predictable building businesses, the second division, and acquired more RMI businesses. It declared this process complete when it disposed of builder Walter Lilly in 2024. Now it is entirely Engineering Services.

RMI is an attractive business. Renew does small but necessary jobs that are completed quickly and paid out of operating budgets rather than more lumpy capital expenditure. This makes earnings more predictable.

The work is labour, rather than capital intensive. By employing and training engineers, as opposed to relying on subcontractors, Renew has more control of costs and quality than some rivals.

Since 2018, it has grown revenue and profit at a low double-digit growth rate, while earning high returns on capital. A small percentage of this growth (equivalent to 2% compound annual growth rate, or CAGR) was not funded from the company's own operations but by a placing of new shares to buy QTS. Consequently, we should deduct 2% from the growth rates to see the benefit to shareholders, whose holdings have been diluted.

Rail delays

2025, was a sub-par year. Renew’s biggest customer, Network Rail, deferred some renewal (as distinct, I think, from maintenance) projects.

Renew links this downturn to the transition between Rail funding cycles. The current five-year National Rail funding cycle, Control Period 7 (CP7) started in April 2024, yet activity remains subdued.

Rail remains Renew’s biggest market. Network Rail’s contribution to revenue declined from 39.4% to 36.8%, causing a 2.5% decline in the group’s organic revenue growth. Acquisitions, though, contributed to an increase in total revenue of 7% and adjusted profit grew 2%. They also bumped debt up to still modest levels.

The company says it is picking up more Rail maintenance work, compensating somewhat for delayed renewal projects. Based on past experience, it remains confident that National Rail's spending will “normalise” through the cycle.

Maybe Network Rail will finish the cycle having invested all the money it has committed. I am not taking this for granted though, because the government is strapped for cash and has many competing demands.

- Investment outlook: expert opinion, analysis and ideas

- The shares attracting fund managers at start of 2026

Funding constraints could exist in other markets too, depending on the state of the economy and government finances.

There may be another risk lurking in the smallprint of Renew’s annual report. Provisions for historical claims against Allenbuild, a builder owned by the company before 2014, are £10 million. This is Renew’s best guesstimate of the cost of settling legal claims. These relate at least in part to cladding and fire safety.

Increases in the provision have already been recognised as a cost in past profit figures, but it will drain cash flow as settlements are made. The amount is not alarming, about 20% of a good year's cash flow, and it will not all be paid out in a single year.

But the provision has nearly doubled since 2020 even though the company has paid out £11.1 milion. Renew says there may be more claims, so we need to keep an eye on it.

Although I think it should, Renew does not routinely disclose the revenue it earns in each of its major markets in its printed reports and results presentations. This makes it hard to work out Renew's market share and susceptibility to ructions in particular markets.

During Renew’s 2025 full-year results presentation Paul Scott did give out the approximate revenue share for each division, though. From these numbers, I have derived approximate revenue by market and approximate market share:

Renew 2025 | Approx % of Revenue | Approx revenue (£m) | Annual addressable market (£m) | Approx % of addressable market |

Rail | 40% | 432.4 | 5,400.00 | 8.0% |

Environment | 30% | 324.3 | 10,000.00 | 3.2% |

Energy | 15% | 162.15 | 9,200.00 | 1.8% |

Infrastructure | 15% | 162.15 | 5,600.00 | 2.9% |

Source: Annual results presentation 2025. Market revenues are calculated from approximate percentages spoken by Paul Scott.

In the table, “Environment” mostly relates to water, Energy to electricity and nuclear, and “Infrastructure” to roads and telecommunications. The company also revealed that Rail is more profitable, earning a profit margin of 7-8% compared to 6-7% in the other markets.

Renew’s market shares range from just under 2% to 8%, which may mean it has plenty of room to grow just by executing an already successful business model.

Since 2010, 58% of revenue growth and 55% of profit growth has come from acquisitions. These were largely self-funded, so the strategy is probably sustainable.

In line with Renew’s business model, the company targets prime contractors, local businesses that work directly for infrastructure operators and employ their own workforces.

Acquisitions give Renew new capabilities and increase its geographical reach. Subsidiaries also team up to fulfil projects requiring their combined skills.

- My SIPP and ISA investing goals for 2026

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

At the beginning of Renew’s 2025 financial year (October 2024) it acquired Full Circle, which repairs, maintains and monitors onshore wind turbines. Full Circle added 200 skilled technicians to Renew (which I covered in last year’s write up).

Just after the year end, in October 2025, Renew acquired Emerald Power and slotted it into Excalon, another subsidiary. Emerald Power maintains and upgrades overhead power lines in the North West. Excalon works on underground cables. Both companies address the need for a beefed-up electricity grid required for the shift to green energy.

High levels of Return on Total Invested Capital (including the cost of acquisitions) and reasonable levels of organic profit growth indicate the strategy has added value.

It has also reduced Renew’s dependence on Network Rail, soon to be the core of nationalised train and infrastructure operator Great British Rail, which accounts for most of the revenue from the Rail market.

Employee friendly

Judging whether companies truly provide employees with rewarding careers is tricky, but this is the core of Renew's strategy.

Annual reports are liberal with fine words about staff and less so with data. Renew trumpets apprenticeships, graduate trainee, and leadership training schemes. It also says its 4,500-odd employees received nearly 24,000 days of training, more than five days each if it were distributed evenly.

Although I have previously criticised Renew for not disclosing employee turnover rates, which I consider to be the most useful indicator, Paul Scott said employee turnover was again below 15% in 2025 in the 2025 full-year results presentation. He described this benchmark as industry leading. I think it should be a key performance indicator printed in the annual report.

He also said: “There is simply no question that local delivery by high-quality, stable, and responsive teams improves customer relations leading to greater market share.”

Scoring Renew: warm feelings

This is the essence of the business model, and it warms me to the company. Perhaps it is embodied in the chief executive himself. He joined the company in 2003, previously managed one of its subsidiaries and joined the board in 2015 as chief engineering officer.

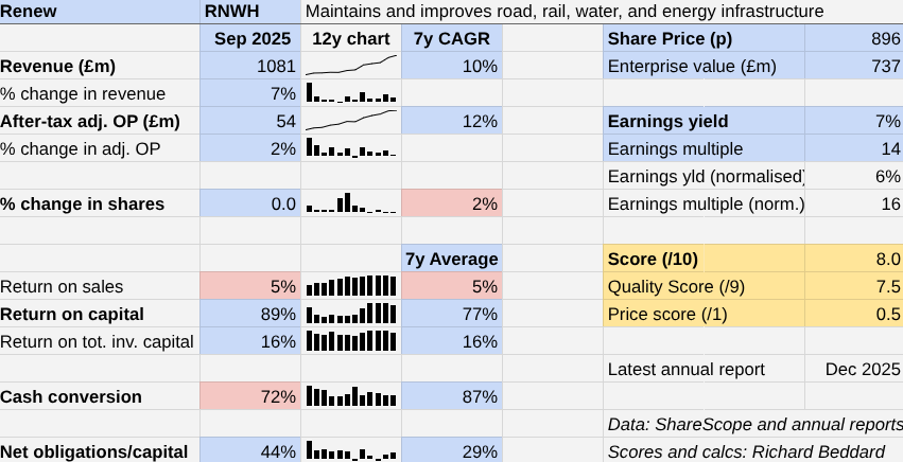

Renew | RNWH | Maintains and improves road, rail, water, and energy infrastructure | 08/01/2026 | 8/10 |

How capably has Renew made money? | 2.5 | |||

Under its current executives, Renew has achieved low double-digit growth in revenue and profit and high returns on capital since 2018. The share count has increased at 2% CAGR to fund the acquisition of businesses in diverse sectors with skilled workforces. It has invested to train, motivate and equip them. | ||||

How big are the risks? | 2.0 | |||

Renew is paid out of operating budgets of infrastructure owners, which has generated reliable earnings. Nearly 40% of revenue comes from Network Rail but relates to many projects. Provisions against legal claims against a business sold in 2014 are worrying, as is the possibility of austerity. | ||||

How fair and coherent is its strategy? | 3.0 | |||

By focusing on early recruitment and the training and development of employees, Renew provides better service than rivals depending on subcontractors. Subsidiaries work together on projects. High ROTIC and organic growth suggests they may generate more value than they would alone. | ||||

How low (high) is the share price compared to normalised profit? | 0.5 | |||

Low. A share price of 896p values the enterprise at £737 million, about 16 times normalised profit. | ||||

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explained here) | ||||

30 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 5 out of 10 to be worthy of long-term investment in sizes determined by the ideal holding size (ihs%).

Hollywood Bowl Group (LSE:BOWL) has published its annual report and is due to be re-scored.

# | company | description | score | qual | price | ih% |

1 | FW Thorpe | Makes lighting systems for commercial, industrial and public settings | 9.0 | 0.9 | 9.7% | |

2 | Howden Joinery | Supplies kitchens to small builders | 8.0 | 0.6 | 7.1% | |

3 | James Latham | Distributes imported panel products, timber, and laminates | 7.5 | 1.0 | 7.0% | |

4 | Bunzl | Distributes essential everyday items consumed by organisations | 7.5 | 0.7 | 6.3% | |

5 | Renew | Maintains and improves road, rail, water, and energy infrastructure | 8.0 | 7.5 | 0.5 | 6.1% |

6 | Softcat | Sells software and hardware to businesses and public sector | 7.5 | 0.5 | 6.1% | |

7 | Jet2 | Package tour operator and leisure airline | 7.0 | 1.0 | 5.9% | |

8 | Solid State | Manufactures electronic systems and distributes components | 7.0 | 0.9 | 5.8% | |

9 | Hollywood Bowl | Operates tenpin bowling centres | 7.5 | 0.1 | 5.3% | |

10 | Bloomsbury Publishing | Publishes books and educational resources | 7.5 | 0.0 | 5.0% | |

11 | Churchill China | Manufactures tableware for restaurants etc. | 6.5 | 1.0 | 5.0% | |

12 | Auto Trader | Online marketplace for motor vehicles | 7.0 | 0.5 | 5.0% | |

13 | Oxford Instruments | Makes imaging and semiconductor manufacturing systems | 6.5 | 1.0 | 4.9% | |

14 | Cohort | Manufactures/supplies defence tech, training, consultancy | 8.0 | -0.7 | 4.6% | |

15 | Porvair | Manufactures filters and laboratory equipment | 8.0 | -0.9 | 4.3% | |

16 | Anpario | Manufactures natural animal feed additives | 7.0 | 0.0 | 4.1% | |

17 | Advanced Medical Solutions | Manufactures surgical adhesives, sutures and dressings | 6.5 | 0.5 | 4.0% | |

18 | Focusrite | Designs recording equipment, synthesisers and sound systems | 6.0 | 1.0 | 4.0% | |

19 | Macfarlane | Distributes and manufactures protective packaging | 6.0 | 1.0 | 4.0% | |

20 | Cake Box | Cake shop franchise and sweet manufacturer | 7.0 | 0.0 | 4.0% | |

21 | Volution | Manufacturer of ventilation products | 8.5 | -1.6 | 3.8% | |

22 | YouGov | Surveys public opinion and conducts market research online | 6.0 | 0.9 | 3.8% | |

23 | Keystone Law | Operates a network of self-employed lawyers | 7.5 | -0.7 | 3.7% | |

24 | Judges Scientific | Manufactures scientific instruments | 7.0 | -0.2 | 3.6% | |

25 | Games Workshop | Designs, makes and distributes Warhammer. Licenses IP | 8.5 | -1.7 | 3.6% | |

26 | Goodwin | Casts and machines steel and processes minerals for niche markets | 8.5 | -2.1 | 2.8% | |

27 | 4Imprint | Customises and distributes promotional goods | 8.0 | -1.8 | 2.5% | |

28 | Tristel | Manufactures hospital disinfectant | 8.0 | -2.2 | 2.5% | |

29 | Renishaw | Makes tools and systems for manufacturers | 6.5 | -0.7 | 2.5% | |

30 | Quartix | Supplies vehicle tracking systems to small fleets | 7.5 | -1.9 | 2.5% |

Click on a share's score to see a breakdown (scores may have changed due to movements in share price). Key: qual is the share’s score out of 9 for the three quality factors (capabilities, risks, and strategy), price is the price score from -3 to +1, and ih% is the suggested ideal holding size as a percentage of the total value of a diversified portfolio.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Renew and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.