Shares for the future: reconsidering two rejects

Both these businesses have previously been ejected from his Decision Engine, but analyst Richard Beddard thinks they are worth keeping an eye on.

6th February 2026 15:00

by Richard Beddard from interactive investor

Today, I’m updating the stories of two companies I’ve previously scored but no longer feel able to. They are, in some ways, promising, so we should keep tabs on them.

- Invest with ii: Open a Stocks & Shares ISA | What is a Stocks & Shares ISA? | ISA Offers & Cashback

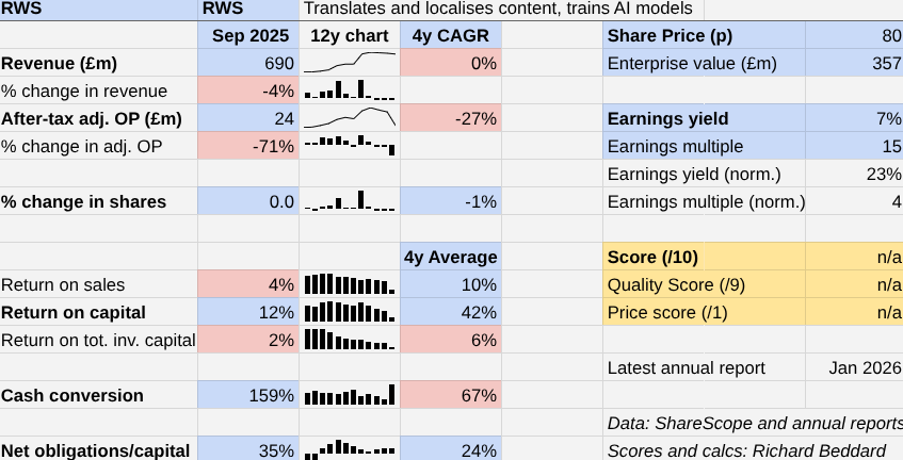

RWS: top of the ‘too hard’ pile

Since I last scored translation company RWS Holdings (LSE:RWS), it has appointed a new chief executive and reorganised itself into three new divisions. From 2026, it will segment its results three ways: Generate, Transform and Protect.

Generate comprises a newish business devoted to training AI models, and content management software systems that RWS has acquired over the years. Transform is the bulk of RWS’ translation and localisation business. Protect, is its oldest speciality - patent translation and services.

RWS’ pitch used to be quite straightforward. It grew by acquisition into one of the largest language service providers employing a network of linguists to translate and localise content in specialist niches, requiring legal, regulatory and scientific knowledge. People with subject and language skills were its competitive advantage. They used technology, in the form of machine translation, to be more efficient.

Today RWS pitches itself as “AI first”. It has a mountain of specialist translations to train AI models with, whether they are in-house or customers’ models. Accuracy and safety is maintained by keeping humans “in the loop”, verifying and adding emotional and cultural nuance.

Despite earning 71% less adjusted after-tax operating profit in the year to September 2025, RWS achieved 12% return on capital, which is above the 8-10% I consider viable. But the company’s profit is so heavily adjusted, and it has written off so much capital, I don’t have much confidence in the figure.

Cash flow was more impressive than adjusted profit and better than cash flow in 2024, but less than half peak cash flow in 2022. The company is making money, but I do not have a view on how much it might earn in future, because the business is changing so much.

I don’t know whether rising costs and a slow decline of revenue growth are the result of the investment required to establish the new business model or a permanent feature of it. Neither do I know if RWS’ AI solutions will win in the market.

While it has acquired translation software and has long used neural machine translation, the famous conversational abilities of Large Language Models (LLM) means the market is adopting them for aspects of translation.

RWS partners with larger and smaller LLM providers. Its emphasis on “private models” trained on its own data tightly integrated with RWS software suggests it is at least trying to differentiate its offering.

The company gave indicative revenue figures for each new division in its 2025 annual report. Transform was by far the largest, contributing 67% of revenue. Generate contributed 19% and Protect contributed 14%.

It is the smaller two divisions that the company anticipates will grow in 2026, while it stabilises Transform over the medium term. Overall, RWS expects revenue and profit to return to modest growth in 2026.

Transform is shrinking partly because more of its output is generated by software sold as a service. This replaces revenue up front with recurring subscriptions. I think it is also shrinking because human translation commands a higher price than machine translation.

I’m not even sure how dramatic the strategic shift is. RWS has been inconsistent in how it reports the size of its “linguistic network”. In previous years, it has disclosed the number of in-house and freelance linguists.

In 2022, there were more than 2,000 in-house and over 30,000 freelancers. In 2024, there were just under 2,000 in-house, and over 40,000 freelancers. In 2025, RWS didn’t provide a breakdown but counted 43,000 in its linguistic network.

RWS may be AI first, but it looks like there are a lot of people still in the loop. Its reputation with large multinationals should also be an asset in a time when our trust in content is being challenged.

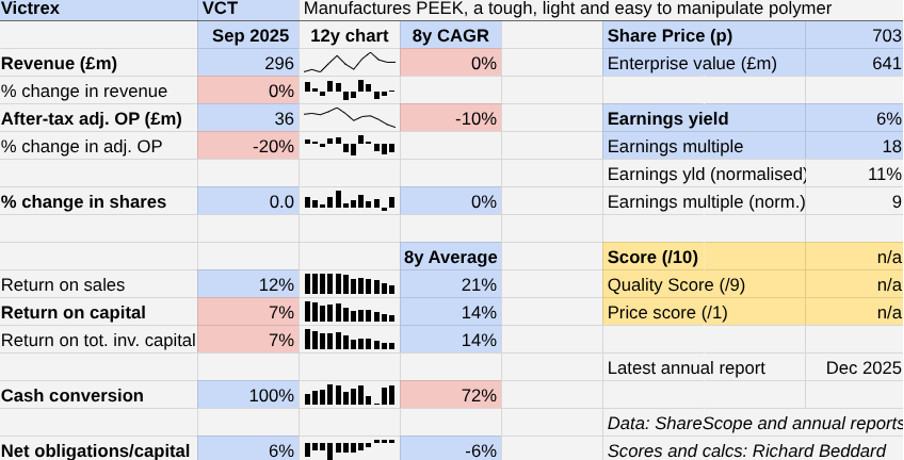

Victrex: investing hard, going backwards

Jakob Siggurdsson resigned as chief executive of Victrex (LSE:VCT) on the first day of this year. His entire eight-year tenure has delayed gratification.

Siggurdsson inherited a newish strategy, to grow the market for PEEK, a tough polymer used in components across industries where performance and lightness is important.

ICI, once Victrex’s parent, invented PEEK and Victrex is the dominant producer, hence the requirement to find new uses for the material. With manufacturing partners and on its own, Victrex has invented new PEEK parts for planes, medical implants and oil pipelines for example.

- Are high fees chipping away at your investment returns?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

For a decade, Victrex has waved the more than £50 million potential annual revenue from each of these “mega-programmes” under investors’ noses, but none of them have come close. In 2025, five surviving mega-programmes brought in £9.1 million, over £1 million less than in 2024. They contributed about 3% of total revenue.

The strategy is still called Polymer and Parts, but it hasn’t delivered growth in revenue, and the company is much less profitable than it was in its heyday.

In the year to September 2025, Victrex earned 7% return on capital, below my quality threshold and far below the returns in the mid-twenties it achieved a decade and more ago.

James Routh, the new chief executive, may have a decent first year. The company is cutting costs to boost profitability, and Victrex’s new Chinese factory is operational but working below capacity.

This development ends a phase of heavy investment, but Victrex expects the factory to lose money and use up cash in 2026 while it scales up. Along with the mega-programmes, becoming a local supplier to the increasingly inwardly focused Chinese market is in current management’s view, Victrex’s best hope of turning things around.

I want to see what new management has to say about that.

30 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 5 out of 10 to be worthy of long-term investment in sizes determined by the ideal holding size (ihs%).

company | description | score | qual | price | ih% | |

1 | FW Thorpe | Makes lighting systems for commercial, industrial and public settings | 9.0 | 0.8 | 9.5% | |

2 | Hollywood Bowl | Operates tenpin bowling centres | 8.0 | 0.5 | 7.1% | |

3 | James Latham | Distributes imported panel products, timber, and laminates | 7.5 | 1.0 | 7.0% | |

4 | Howden Joinery | Supplies kitchens to small builders | 8.0 | 0.5 | 6.9% | |

5 | Softcat | Sells software and hardware to businesses and public sector | 7.5 | 0.8 | 6.6% | |

6 | Bunzl | Distributes essential everyday items consumed by organisations | 7.5 | 0.6 | 6.2% | |

7 | Jet2 | Flies people to holiday locations, often on package tours | 7.0 | 1.0 | 6.0% | |

8 | Solid State | Manufactures electronic systems and distributes components | 7.0 | 0.9 | 5.9% | |

9 | Renew | Maintains and improves road, rail, water, and energy infrastructure | 7.5 | 0.4 | 5.8% | |

10 | Auto Trader | Online marketplace for motor vehicles | 7.0 | 0.8 | 5.6% | |

11 | Bloomsbury Publishing | Publishes books and educational resources | 7.5 | 0.2 | 5.3% | |

12 | Churchill China | Manufactures tableware for restaurants etc. | 6.5 | 1.0 | 5.0% | |

13 | Oxford Instruments | Makes imaging and semiconductor manufacturing systems | 6.5 | 0.9 | 4.8% | |

14 | Judges Scientific | Manufactures scientific instruments | 7.0 | 0.2 | 4.4% | |

15 | Advanced Medical Solutions | Manufactures surgical adhesives, sutures and dressings | 6.5 | 0.5 | 4.1% | |

16 | Porvair | Manufactures filters and laboratory equipment | 8.0 | -1.0 | 4.1% | |

17 | Focusrite | Designs recording equipment, synthesisers and sound systems | 6.0 | 1.0 | 4.0% | |

18 | Cake Box | Cake shop franchise and sweet manufacturer | 7.0 | 0.0 | 4.0% | |

19 | Macfarlane | Distributes and manufactures protective packaging | 6.0 | 1.0 | 4.0% | |

20 | Cohort | Manufactures/supplies defence tech, training, consultancy | 8.0 | -1.0 | 4.0% | |

21 | YouGov | Surveys public opinion and conducts market research online | 6.0 | 1.0 | 3.9% | |

22 | Volution | Manufacturer of ventilation products | 8.5 | -1.6 | 3.7% | |

23 | Games Workshop | Designs, makes and distributes Warhammer. Licences IP | 8.5 | -1.7 | 3.7% | |

24 | Keystone Law | Operates a network of self-employed lawyers | 7.5 | -0.7 | 3.5% | |

25 | 4Imprint | Customises and distributes promotional goods | 8.0 | -1.7 | 2.6% | |

26 | Anpario | Manufactures natural animal feed additives | 7.0 | -0.7 | 2.6% | |

27 | Goodwin | Casts and machines steel and processes minerals for niche markets | 8.5 | -2.4 | 2.5% | |

28 | Renishaw | Makes tools and systems for manufacturers | 6.5 | -0.6 | 2.5% | |

29 | Tristel | Manufactures hospital disinfectant | 8.0 | -2.2 | 2.5% | |

30 | Quartix | Supplies vehicle tracking systems to small fleets | 7.5 | -1.9 | 2.5% |

Click on a share's score to see a breakdown (scores may have changed due to movements in share price). Key: qual is the share’s score out of 9 for the three quality factors (capabilities, risks, and strategy), price is the price score from -3 to +1, and ih% is the suggested ideal holding size as a percentage of the total value of a diversified portfolio.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine and Share Sleuth, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.